As most other currencies, the Canadian dollar gained on the US dollar today. The loonie also rallied versus the Japanese yen but was unable to beat the extremely powerful euro. Canada’s imports were falling while exports were rising in February. This led to the decline of the trade balance deficit from C$1.5 billion in January to C$984 million in February. Forecasts ahead of the report were far more pessimistic, promising an increase of the trade gap … “Canadian Dollar Gains on Greenback & Yen, Unable to Beat Euro”

Month: April 2015

US Dollar Demonstrates Surprising Weakness

The US dollar was surprisingly weak today, falling to the lowest level in almost a week against the euro. The greenback fared somewhat better against the Great Britain pound and the Japanese yen, moving sideways. It was surprising to see the US currency so soft today. While the weakness of dollar could be explained by poor economic reports yesterday, today such explanations would not be valid as all the economic data from … “US Dollar Demonstrates Surprising Weakness”

NZ Dollar Demonstrates Strength vs. Rivals

The New Zealand dollar rallied today with the help of positive macroeconomic data and the weakness of the US currency. The kiwi rallied even as prices for raw materials fell, driving commodity-related currencies down. The New Zealand currency fared far better than its Australian counterpart, managing to erase its losses and gain on the US dollar and the Japanese yen. While commodities were in decline today, pushing growth-related currencies lower, the ANZ Commodity Price … “NZ Dollar Demonstrates Strength vs. Rivals”

Australian Dollar Sinks with Prices for Iron Ore

The Australian dollar sank today, reaching the lowest level since May 2009 against its US counterpart. Australia’s economy relies strongly on export of raw materials, linking the performance of the Aussie to movement of commodity prices. The Australian dollar dropped today with the decline of commodities and iron ore in particular, which fell to the lowest level in at least seven months. The widening trade balance deficit was also detrimental to the currency. The Aussie was the weakest … “Australian Dollar Sinks with Prices for Iron Ore”

EUR/USD: Trading the US NFP April 2 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 13:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP April 2 2015”

Party nearly over for USD bulls – HSBC

We have seen some US indicators lifting their heads, while others are still on looking disappointing, including the important ADP NFP. What’s next for the US dollar? The team at HSBC says that the party for the greenback bulls is nearly over: Here is their view, courtesy of eFXnews: The USD bull run feels close to the … “Party nearly over for USD bulls – HSBC”

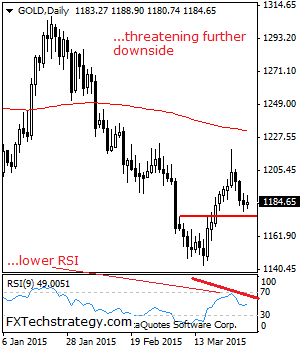

GOLD: Remains Weak And Vulnerable

With GOLD’s bias continuing to point lower, further bearishness is now envisaged. This is consistent with its short term weakness triggered off the 1,219.51 level the past week. On the downside, support comes in at the 1,170.00 level where a break will aim at the 1,150.00 level. Below here if seen could trigger further downside … “GOLD: Remains Weak And Vulnerable”

Lackluster US Economic Indicators End Dollar’s Rally

The US dollar halted its rally on Wednesday, falling against some of its most-traded counterparts. The reason for the drop was the lackluster economic data that hurt optimism of dollar bulls. The greenback kept its losses on Thursday. The week started on a positive note for the US currency as fundamental reports were mostly positive, resulting in a rally. Yet the recovery proved to be short-lived as economic data took a turn for the worse yet again. ADP employment … “Lackluster US Economic Indicators End Dollar’s Rally”

Forex Crunch Key Metrics March 2015

March saw an upswing in site metrics after a relative slowdown in February (after the SNBomb influenced January). Page views are up more than 15% in comparison to February and 75% in comparison to March 2014. What will we see in the April? Hopefully volatility will extend into the second quarter and beyond. Website: Page Views: 812,686. … “Forex Crunch Key Metrics March 2015”

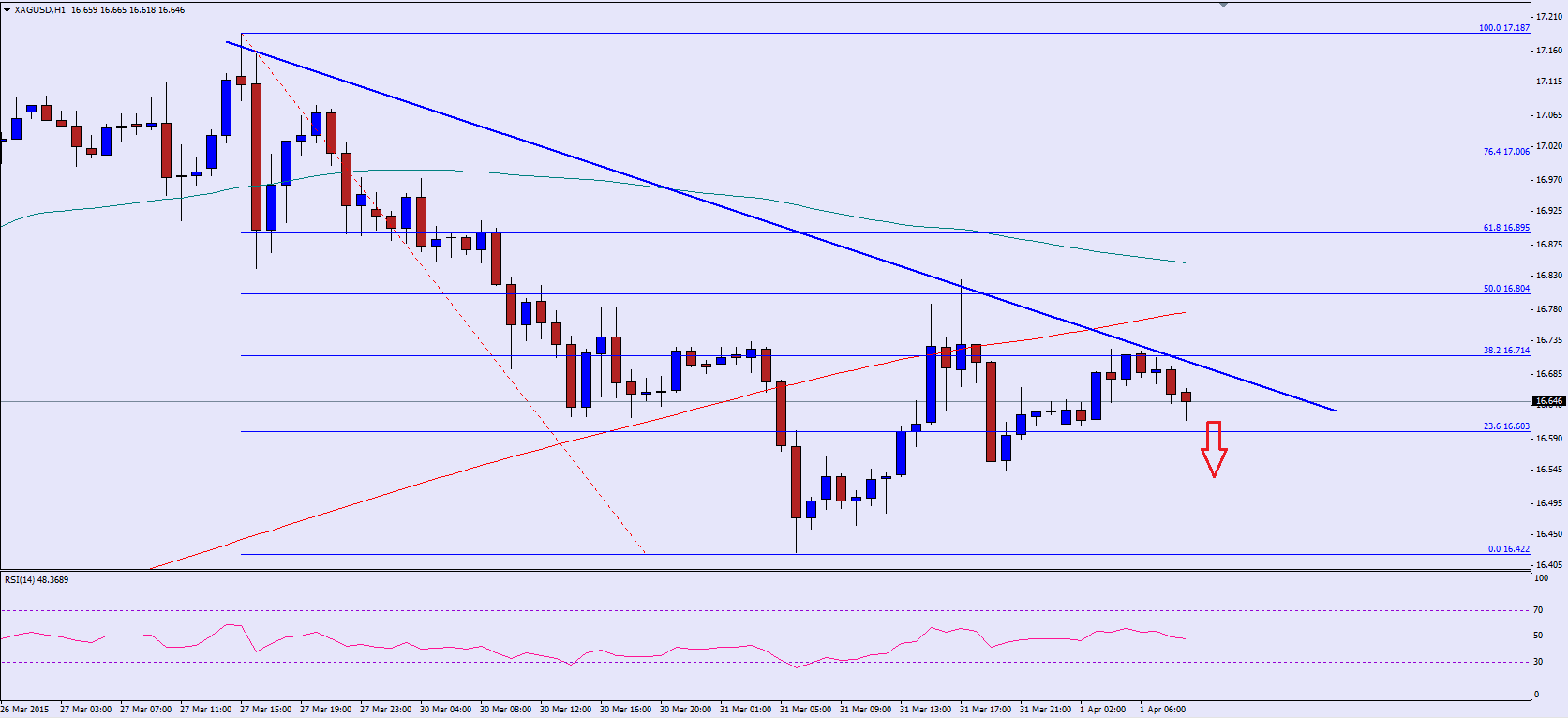

SILVER Failure to Break $16.80 Might Cause Downside

The US dollar was trading mix, as earlier it was seen gaining bids and then later it lost the momentum. SILVER traded higher recently, but failed to break a crucial resistance area around the $16.80 levels. There are a couple of important releases lined up today in the US. The Institute for Supply Management (ISM) … “SILVER Failure to Break $16.80 Might Cause Downside”