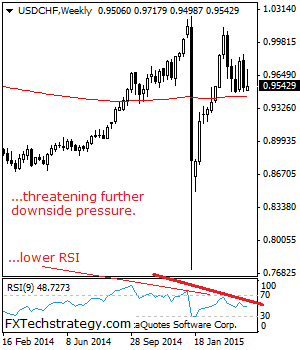

USDCHF: With a reversal of almost all of its past week gains seen at the end of the week to close slightly higher, USDCHF now faces the risk of a move lower in the new week. On the downside, support comes in at the 0.9500 level. A turn below here will open the door for … “USDCHF: Vulnerable, Risk Points Lower”

Month: April 2015

Sell EUR/USD At Current Levels: Here Is Why – Barclays

EUR/USD managed to move a bit higher in a week that saw not so convincing euro-zone news but much bigger disappointments from the US. Is Greece the reason to sell? Not exactly, but Barclays has a conviction to be short at current levels. Here is why: Here is their view, courtesy of eFXnews: Despite the lack of … “Sell EUR/USD At Current Levels: Here Is Why – Barclays”

Dollar Ends Week Mixed, Remaining Weakest Currency in April

The US dollar ended the week mixed but will likely end April as the weakest currency on the Forex market. The reason for the lackluster performance is the fact that many market participants no longer anticipate an early interest rate hike from the Federal Reserve. The US currency was demonstrating strength previously as traders speculated about a possibility of an early interest rate hike. Yet the recent wave of poor economic data made such … “Dollar Ends Week Mixed, Remaining Weakest Currency in April”

EUR Ends Friday Higher vs. USD, Lower vs. GBP & JPY

The euro ended the Friday’s trading session higher against the US dollar but lower against some other most-traded currencies, including the Great Britain pound and the Japanese yen. Friday’s economic data from Europe was mildly positive as the Ifo Business Climate Index for Germany improved to 108.6 in April from March’s 107.9. Yet the favorable indicator did not provide a substantial boost for the currency of the eurozone. The major negative factor remains … “EUR Ends Friday Higher vs. USD, Lower vs. GBP & JPY”

China’s Central Bank Sets Yuan Higher vs. Dollar

The Chinese yuan rose against the US dollar today. The reason for the gain was not like usual factors that drive the currency market but rather a direct influence of the nation’s central bank. The yuan fell versus the euro. Today, the Peopleâs Bank of China set the daily reference rate for the currency at the strongest level in three months. While the recent stream of underwhelming economic data and news about stimulus might have driven other … “China’s Central Bank Sets Yuan Higher vs. Dollar”

US GDP may have contracted in Q1 – USD shrugs it off

Core durable goods orders fell by 0.2% in March, worse than a rise of 0.2% expected. And, this came on top of a downwards revision for last month’s number. Taking one step back, the last time that core orders enjoyed a rise was back in September. The USD retreated, but then the markets probably remembered … “US GDP may have contracted in Q1 – USD shrugs it off”

Pound Rallies Against Peers

The Great Britain pound rallied against its major peers today, extending the upward move that has started at the beginning of the last week. The currency rose even though yesterday’s economic data from the United Kingdom was rather negative. The sterling has received support from Bank of England policy minutes earlier this week, and it looks like the report was positive enough to continue push the currency higher till … “Pound Rallies Against Peers”

US Dollar Continues Its Slump

Greenback looks to be ready to close out this week lower, thanks to a raft of data and a bit of profit taking. Also weighing on the dollar is a sense of waiting. The Fed meets next week, and many Forex traders are waiting for the outcome of that meeting. Right now, it looks as though the Federal Reserve might have to put off some of its plans for tightening. Concerns about the durable goods data is on the rise, … “US Dollar Continues Its Slump”

Mexican Peso Drops, Some Investors Remain Bullish

The Mexican peso fell today against the US dollar but some investors remain very bullish on the currency, hoping that the growth of the US economy will benefit the peso. Despite the drop of the peso, there are hopes that recovery in the United States, Mexico’s major trading partner, will benefit the Mexican economy and its currency. Prospects for economic reforms in Mexico also provide support for the peso. While the Mexican currency remains vulnerable … “Mexican Peso Drops, Some Investors Remain Bullish”

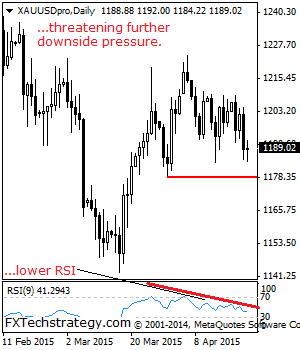

GOLD Maintains Bearish Bias, Eyes Key Support

GOLD: With GOLD selling off sharply on Wednesday, further bearishness is expected though presently seen hesitating. Support comes in at the 1,178.39.00 level where a break will aim at the 1,165.00 level. A cut through here will open the door for move lower towards the 1,150.00 level. Below here if seen could trigger further downside … “GOLD Maintains Bearish Bias, Eyes Key Support”