The Australian CPI (Consumer Price Index), which is released each quarter, is an inflation index which measures the change in the price of goods and services charged to consumers. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. … “AUD/USD: Trading the Australian CPI Apr 2015”

Month: April 2015

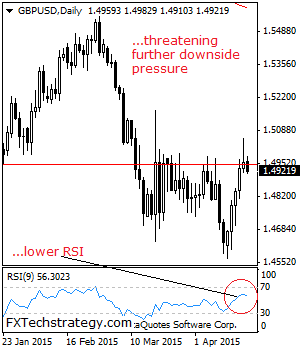

GBP/USD: Weakens, Vulnerable Below Key Resistance

GBPUSD: With GBP seen weak and vulnerable on the back of its rejection candle print on Friday, more decline cannot ruled out. On the downside, support lies at the 1.4850 level where a break if seen will aim at the 1.4800 level. A break of here will turn attention to the 1.4700 level. Further down, … “GBP/USD: Weakens, Vulnerable Below Key Resistance”

NZ Dollar Unable to Rally

The New Zealand dollar attempted to rally on the news about Chinese stimulating measures yet was unable to keep gains and dropped currently. Economic data from New Zealand was not helping the matter at all, showing that deflation accelerated in the South Pacific economy. The New Zealand currency tried to following its Australian peer in rally, but they both fell after the initial boost from China. The most likely reason … “NZ Dollar Unable to Rally”

Chinese Stimulus Helps Australian Dollar

The Australian dollar is getting some help today, thanks to stimulus out of China. With China as a major trading partner to Australia, it’s no wonder that the Aussie gets a boost when economic stimulus is on the table. Over the weekend, the People’s Bank of China announced that it is cutting the amount of cash banks need in reserves. The idea is to encourage banks to lend in order to increase economic growth. Growth has … “Chinese Stimulus Helps Australian Dollar”

UK Elections Impact Pound in Forex Trading

The hotly contested UK elections are impacting the pound in Forex trading, sending the currency mostly lower today. Volatility ahead of the elections is expected to continue, with choppy performance being the norm. Sterling is mostly lower today, struggling against many of its counterparts as volatility takes hold ahead of the elections on May 7. The elections are hotly contested, with the race being too close to call between the outcome between … “UK Elections Impact Pound in Forex Trading”

The Confetti Lady that moved Draghi but not Markets –

The Draghi drama was certainly upgraded this time. We talk about about all the implications of everything that happened and didn’t happen there. We then talk about earnings season and what we should and shouldn’t look out for, take a look at rising oil prices from the M&A angle and conclude with the Canadian dollar. You … “The Confetti Lady that moved Draghi but not Markets –”

USD Index, EUR/USD: Trending Or Turning? – Goldman Sachs

EUR/USD did not fall off the cliff of 1.05 nor did it climb above the 1.1050 mountain. What’s next for the pair, and where is the greenback headed in general? The team at Goldman Sachs weighs in: Here is their view, courtesy of eFXnews: The USD in general seems to have struggled as of late as the … “USD Index, EUR/USD: Trending Or Turning? – Goldman Sachs”

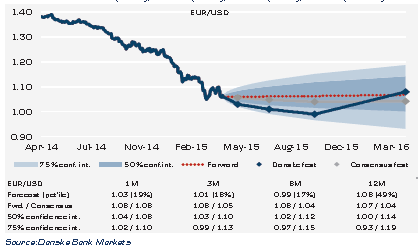

EUR/USD: Growth, Flows, Policy, Valuation, Risks & Forecasts –

What’s the bigger picture regarding euro/dollar? It’s not only technical levels and fundamentals, but also flows. The team at Dankse takes a look at everything moving EUR/USD and reaches a conclusion about the next move: Here is their view, courtesy of eFXnews: Growth. Economic data has surprised on the upside in the eurozone in recent … “EUR/USD: Growth, Flows, Policy, Valuation, Risks & Forecasts –”

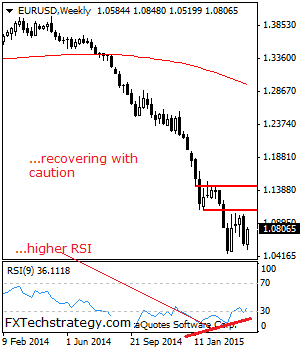

EURUSD: Recovering With Caution

EURUSD: Outlook for EUR remains to the upside after closing higher the past week. However, a mild pullback may occur in the new week as price hesitation signs are now seen on lower level charts. Resistance is seen at 1.0850 level with a cut through here opening the door for more downside towards the 1.0900 … “EURUSD: Recovering With Caution”

Dollar – Biggest Loser on FX Market During Trading Week

The US dollar was the weakest currency on the Forex market during the past trading week as the constant stream of poor economic data muted speculations about an early interest rate hike from the Federal Reserve. The week started poorly for the dollar as the International Monetary Fund shocked the market making a negative revision for US economic growth. The poor luck of the greenback persisted through the whole week as the string of lackluster economic indicators resulted in a huge slump … “Dollar – Biggest Loser on FX Market During Trading Week”