The Canadian dollar rallied earlier during the current trading session, hitting the two-year high versus the euro, with the help of favorable economic data from Canada. Yet the loonie was unable to keep gains and is now trading far below the opening level against other majors. Today’s macroeconomic releases from Canada were extremely good. Consumer inflation accelerated in March while analysts were anticipating slowdown. Retail sales … “Canadian Dollar Unable to Maintain Gains, Moves Below Opening”

Month: April 2015

Euro Struggles to Keep Upward Momentum

The euro was trying to continue its march upward during the Friday’s trading session but had troubles due to the concerns about the wellbeing of the eurozone and Greece in particular. Standard & Poor’s downgraded Greece’s credit rating, announcing: On April 15, 2015, Standard & Poor’s Ratings Services lowered its long- and short-term sovereign credit ratings on the Hellenic Republic (Greece) to ‘CCC+/C’ from ‘B-/B’. At the same time, Standard & Poor’s … “Euro Struggles to Keep Upward Momentum”

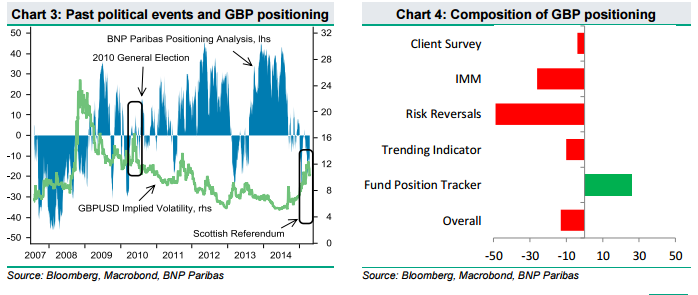

Sterling’s Election Stumble: How To Play It? – BNPP

The upcoming parliamentary elections in the UK on May 7th have already sent shivers and the pound could not sustain the moves against the euro and the dollar, despite a recent recovery. What’s next for sterling? Here is the view from BNP Paribas: Here is their view, courtesy of eFXnews: The relationship between the UK … “Sterling’s Election Stumble: How To Play It? – BNPP”

EURGBP – Consolidates With Upside Bias

EURGBP- With the cross halting its weakness and consolidating, it looks to recover higher. On the downside, support lies at the 0.7150 level where a break will expose the 0.7100 level. Further down, support comes in at the 0.7050 level where a violation will turn attention to the 0.7000 level. On the upside, resistance lies … “EURGBP – Consolidates With Upside Bias”

Poor US Data & Rising Crude Oil Prices Fuel Gains of CAD

The Canadian dollar rose today, climbing to the highest level in almost three months against its US counterpart and the Japanese yen, as poor economic data from the United States and the rally of crude oil prices played in favor of commodity currencies. Futures for WTI crude oil gained 0.57 percent in New York today. The performance of the Canadian currency is strongly tied to moves of oil prices as crude is the biggest Canada’s export. Yesterday’s … “Poor US Data & Rising Crude Oil Prices Fuel Gains of CAD”

Dollar Under Pressure from Weak Economic Data

The US dollar was under pressure from poor macroeconomic indicators lately, and the Thursday’s session was not an exception. While not all of the reports were bad, most of them were not as good as market participants had expected, driving the greenback further down. With housing starts and building permits missing expectations and jobless claims rising more than was predicted, the dollar had no shortage of reasons to drop. The better-than-expected … “Dollar Under Pressure from Weak Economic Data”

How’s your broker’s spread in March? Detailed data for

TradeProofer is a forex trader community where members can benchmark their broker’s quote and trade execution against other members’ brokers. TradeProofer release monthly reports on broker spreads to summarize how the community saw brokers’ spreads. This time we focus on March. The charts show spread distribution of each broker for a selection of 10 currency … “How’s your broker’s spread in March? Detailed data for”

EUR/USD: Trading the University of Michigan Index – April

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer Confidence beats at 95.9 Here are all the details, and 5 possible outcomes for EUR/USD. … “EUR/USD: Trading the University of Michigan Index – April”

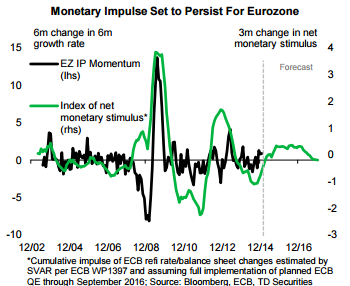

EUR/USD: Temp Bounce; Parity Call Still Intact For Q3 –

The Draghi show was stolen by a protester that interrupted the press conference. And what about the euro? Has its path been altered? The team at TD weighs in, and sees a downwards trajectory. Here’s why, with a chart: Here is their view, courtesy of eFXnews: At today’s ECB press conference, President Draghi continued to distance … “EUR/USD: Temp Bounce; Parity Call Still Intact For Q3 –”

GBPJPY: Halts Weakness, Eyes Recovery

GBPJPY: With GBPJPY closing higher on Tuesday on a rejection candle off its key support zone at 175.30/49, it faces recovery risk in the days ahead. On the downside, support comes in at the 175.50 level where a violation will aim at the 174.50 level. A break below here will target the 174.00 level followed … “GBPJPY: Halts Weakness, Eyes Recovery”