The Canadian dollar gained today, reaching the highest level since May 2013 against the euro, after the Bank of Canada refrained from changing its monetary policy. The rally of crude oil prices added fuel to the loonie’s upward movement. The BoC kept its benchmark interest rate at 0.75 percent at today’s policy meeting. The central bank voiced no concern about the impact of falling oil prices on inflation, thinking that the weak … “Canadian Dollar Gains as BoC Puts Interest Rates on Hold”

Month: April 2015

Australian Dollar Drops, Attempts to Pare Losses

The Australian dollar fell today after economic data from Australia and China disappointed market participants. As of now, the currency almost erased its drop against the US dollar and trimmed losses versus the Japanese yen. The Westpac Melbourne Institute Index of Consumer Sentiment fell by 3.2 percent in April after dropping 1.2 in the previous month. China’s economic growth slowed to 7 percent in the first quarter of 2015 from 7.3 percent during … “Australian Dollar Drops, Attempts to Pare Losses”

Euro Unsteady in Choppy Trading

Euro is a little unsteady this morning, trading mixed against its major counterparts as Mario Draghi talks about eurozone monetary policy. Euro is getting a little help against the US dollar today, thanks to the disappointing retail sales and manufacturing data. Additionally, with stocks on the rise following earnings data (the US market seems to be shrugging off the economic data), the euro has a little more support. Some … “Euro Unsteady in Choppy Trading”

AUD/USD: Trading the Australian jobs Apr 2015

Australian Employment Change, which is released monthly, provides a snapshot of the strength of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one of … “AUD/USD: Trading the Australian jobs Apr 2015”

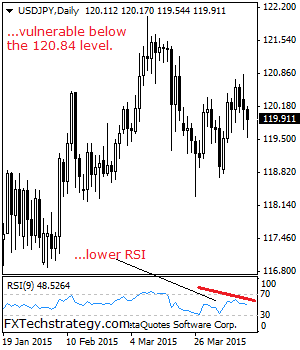

USDJPY Faces Downside Pressure On Price Failure

USDJPY: With the pair capping its gains at 120.84 level to decline on Monday, further weakness is envisaged. On the upside, resistance resides at the 120.50 level with a turn above here aiming at the 121.00 level. A break will target the 121.50 level. Further out, resistance comes in at the 122.00 level where a … “USDJPY Faces Downside Pressure On Price Failure”

Yen Rallies to Highest Since 2013 vs. Euro

The Japanese yen rallied today, touching the highest level since June 2013 against the euro. The reason for the rally is the retreat of the US stocks and the comments from Koichi Hamada, an adviser to Prime Minister Shinzo Abe on monetary policy. Hamada said in the interview with Bloomberg: I donât think itâs a bad thing to send a signal that selling of the yen is coming closer to its limit bit by bit He also stated that … “Yen Rallies to Highest Since 2013 vs. Euro”

Dollar Index Pulls Back After Encountering Resistance

The US dollar index is pulling back today, following its latest attempt at the 100 level. The dollar index is running into resistance, and falling a little bit today. Greenback is down against many of its major counterparts today, following gains yesterday. The US dollar index made another attempt at the 100 level, only to meet resistance and be forced back down. US dollar is also a little … “Dollar Index Pulls Back After Encountering Resistance”

Pound Loses Steam as Consumer Inflation Remains Absent

The Great Britain pound fell today following the release of inflation data from the United Kingdom. The report showed that UK consumer prices remained flat during the previous month. The Office for National Statistics reported that consumer inflation stayed zero in March. While other inflation indexes showed some growth, they were below expectations for the most part. The unfavorable data made the sterling to lose part of its previous gains … “Pound Loses Steam as Consumer Inflation Remains Absent”

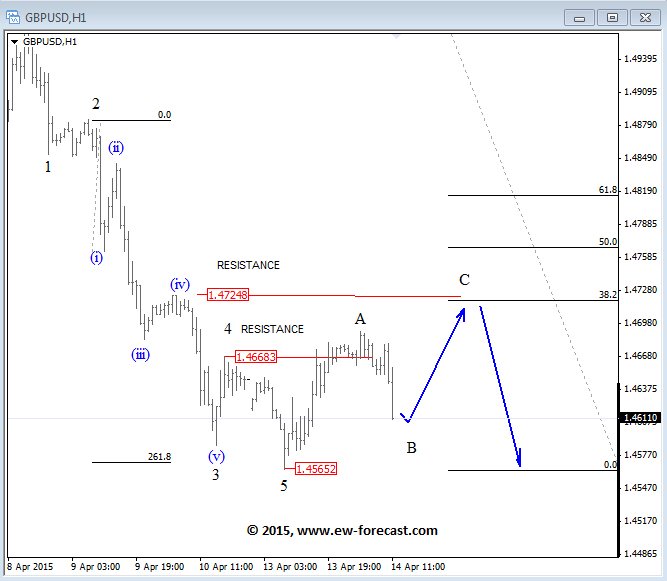

GBP/USD in 3-wave pattern; USD/CAD could fall before rising

The USD is in a bullish mode since last week, but on the short-term charts we noticed that most of the USD pairs are now in correction. On GBPUSD we are looking at a three wave rally after it finished a five wave decline at 1.4565 yesterday, so ideally the price will go to higher … “GBP/USD in 3-wave pattern; USD/CAD could fall before rising”

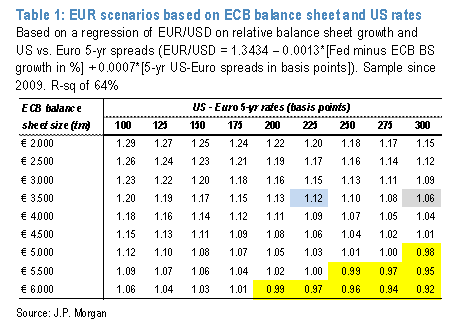

EUR/USD: Towards 1.15 Or Below 1.00 – JP Morgan

EUR/USD is hovering around the lows but is hesitating towards taking the extra step down below the 12 year low of 1.0460. It is also refraining from a meaningful bounce ahead of the ECB meeting. The team at JP Morgan asks what’s next for the common currency and discusses the various factors moving the pair: … “EUR/USD: Towards 1.15 Or Below 1.00 – JP Morgan”