With EUR/USD showing a lot of strength, it is time to ask whether one of the drivers lower has materially changed, especially as bunds have changed course.

Here is the take from Credit Agricole:

Here is their view, courtesy of eFXnews:

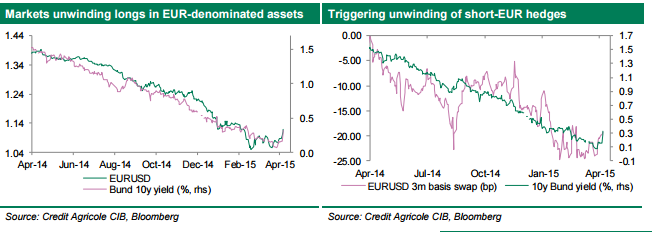

EUR remains surprisingly resilient as investors worry that the ECB may taper its QE before long in the face of returning inflation and recovering economy. This is pushing short rates and EUR higher as EUR-funded carry trades get unwound.

Surging bond yields and weaker stocks are helping as well because investors are cutting short-EUR hedges as they reduce their Eurozone-exposure. Indeed, EUR basis swap rates are bouncing off the lows pointing at waning appetite to sell EUR forward.

Is this the end of EUR-funded carry trades? We doubt it. We think it is premature to expect that the ECB will be adjusting QE anytime soon. Indeed, Eurozone inflation expectations have stabilised but remain close to the lows. In addition, Greece will remain a worry even as hopes for a deal between Athens and its creditors are growing ahead of the 11 May Eurogroup meeting.

In particular, we think that fears about Grexit could intensify again once Athens and its creditors start negotiating a third sovereign bailout later on this year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.