The Canadian dollar enjoyed some significant volatility of late. IS it experiencing a “rotation”? EUR/USD experienced a nice rally, but could not keep up and dropped sharply.

The team at CIBC explains the forces behind these currencies:

Here is their view, courtesy of eFXnews:

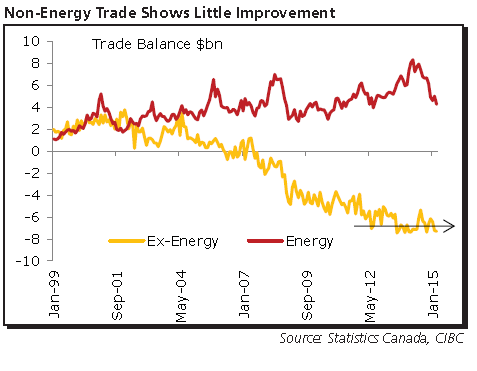

CAD: Rotation Starting to Emerge? Concerns surrounding the rotation of Canadian growth (towards manufacturing and non-energy exports) has taken up almost as much media attention as concerns regarding the Blue Jays’ starting rotation. So far, nonenergy exports have failed to gain much traction.

We’ll need the C$ to remain weak for that trend to emerge, suggesting that dollar-Canada isn’t likely to spend much if any time below $1.20. That said, with US growth picking up, improving non-energy exports and a rebound in oil prices will brighten Canada’s trade outlook later in the year, preventing the C$ from getting any weaker than it was in March.

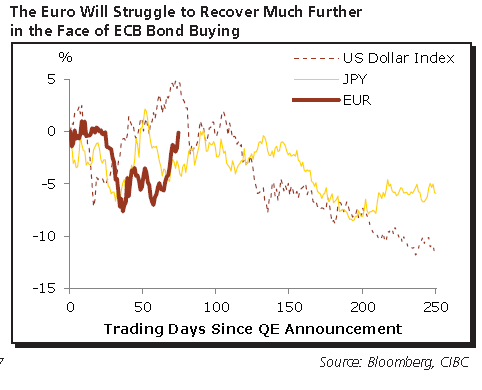

EUR Strength Facing off Against the ECB. With European yields on the rise and US data releases continuing to disappoint, the euro has staged a rebound and broken the trend of depreciation that began more than two years ago. Although the euro has bounced off its lows around $1.05, don’t expect much more of a recovery in the near term, with the ECB still purchasing €60 bn worth of bonds per month. In the year that followed the announcements of both the Fed and BoJ’s first rounds of QE, their currencies depreciated 12% and 6%, respectively.

As such, in the near term the presence of the ECB in the market and worries over any Greek fallout will hold the currency back from appreciating much further. Nevertheless, economic green shoots in the Eurozone should prevent EURUSD from dipping beneath its previous lows of 1.05.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.