The pound has certainly had its share of action, with significant intra-day drops and rises. What’s next for sterling?

The team at Deutsche Bank lists 3 reasons to remain long:

Here is their view, courtesy of eFXnews:

In a special note today, Deutsche Bank advises clients to stay long GBP, arguing that there is still value in buying sterling, particularly against the euro. DB outlines 3 main reasons behind this call.

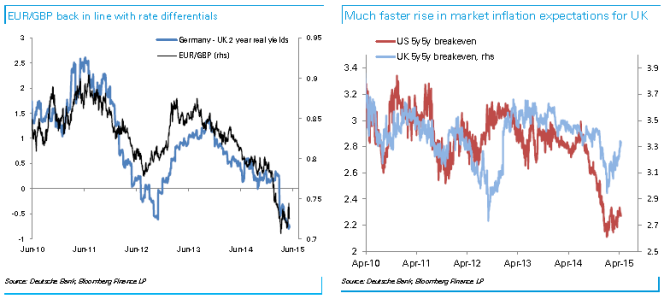

First, the recent pause in trends has allowed GBP to move back into line with medium-term valuation metrics.

“EUR/GBP now looks slightly expensive relative to real rate differentials,” DB argues.

Second, the market remains short pounds.

“CFTC data as of last Tuesday continues to show short GBP positions even as dollar positioning has lightened up or reversed against other currencies (NZD and CHF in particular). The TFF report shows asset managers have barely pared a very large short,” DB clarifies.

Third, cyclical drivers remain supportive.

“Underlying wage growth has continued to be robust and surveys report higher pay settlements offsetting falls in input costs for companies,” DB adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.