EUR/USD rallied hard on the poor US retail sales report. What’s next for the pair?

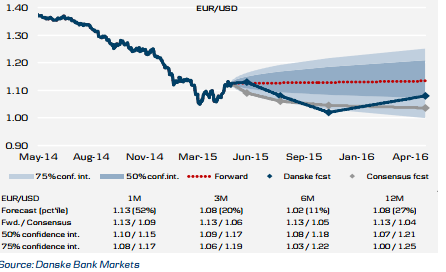

The team at Danske explain the current situation and provide forecasts for 1m, 3m, 6m and 12 months.

Here is their view, courtesy of eFXnews:

Deflation deceleration warns of EUR/USD upside later…

− Stretched positioning in terms of ‘long USD’ made the ground fertile for correction, and as investors reassessed deflation trades, USD was vulnerable in an environment of deflation deceleration.

1. Since mid-January, low crude-oil prices have quietly ticked higher, and base-metal prices are now following. In our view the OPEC price war is over and price risks are becoming more two-sided (versus down previously).

2. Markets appear increasingly willing to buy into the effectiveness of past central-bank actions. Break-even inflation rates have edged higher in Japan and in the UK, and yield curves have steepened from the long end in the euro area and the US, pointing to the pricing of a less dire growth outlook.

… but stilltoo early for a wider pricing of ‘re-flation’

1. Markets need to get clearer confirmation that eurozone inflation has bottomed out, and that a turn is not solely led by the base effects; an uptick in core inflation and wage growth will be required as well.

2. Draghi will be keen to emphasise the ECB’s commitment to the QE scheme, including its open-ended nature, and thus do his best to dampen any discussion of the ECB starting to taper purchases prematurely.

EUR weakness to stay near term – and we still believe a first Fed hike will spur USD strength over the summer.

Forecast: 1.13 (1M), 1.08 (3M), 1.02 (6M), 1.08 (12M).

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.