The pound has certainly moved higher, continuing its post-election rally, despite mixed events.

Could it be entering a period of calm? The team at BNP Paribas explains:

Here is their view, courtesy of eFXnews:

With the outcome of the UK election much ‘cleaner’ than expected, BNP Paribas believes a return to fundamentals warrants a more positive view on Sterling.

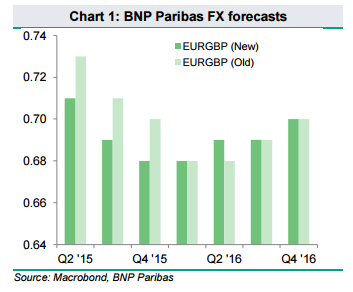

“While previously we expected political risk premium on the GBP to persist after the election, we have now adjusted our forecast for EURGBP and expect the cross to reach its cyclical trough of 0.68 in Q4 2015 rather than 2016,” BNPP projects.

“This is consistent with the estimates of our CLEER model which incorporates our economists’ forecast for the first BoE rate hike in Q1 2016 and puts EURGBP forward-looking fair value at 0.69,” BNPP adds.

“Tactically, we do not believe current EURGBP levels are very attractive for establishing shorts and prefer to wait for the cross to rebound to the 0.74-75 resistance area before considering a sell recommendation,” BNPP advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.