Is the sell off of the USD finally over? It may be the case.

The team at Credit Agricole see the greenback at a turning point and a short opportunity for EUR/USD:

Here is their view, courtesy of eFXnews:

The USD kicked off the week on a strong note, rising against all major currencies. The EUR failed to hold gains near the cycle high of 1.15, adding to our conviction that the single currency could move lower from here.

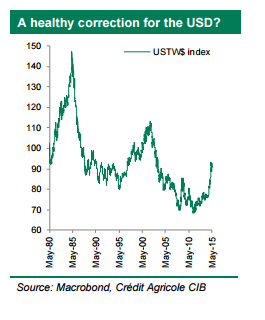

The greenback’s stronger tone reflects some payback following the string of recent losses against a backdrop of lopsided positioning, lofty valuations and soggy US data. Recall, Fed’s trade weighted USD index peaked in March, capping off a 20% rally since mid-2014. It has since retraced only one-fourth of that move

To put the move into context this correction fits the USD’s normal pattern in prior USD bull markets. Arguably, in the past 35 years the USD has experienced six large uptrends (in trade weighted terms). The average drawdown over this period was a tad over 6%. The current drawdown from the recent high is 5%, which suggests the recent move looks more like a healthy correction rather than a change in the trend. Soft US data and the sharp rise in European yields spurred the correction in the USD but we favour fading the weakness in the USD.

We think technical factors have played an important role in the squeeze in European yields, highlighting that rate spreads should shift back in the USD’s favour. While the US economy has lost some momentum at the start of 2015, we still look for the economy to grow above trend for some time. This should help absorb excess slack, pushing the labour market closer to NAIRU by yearend. By the same token, it would only take monthly employment gains of 150k to get the unemployment rate to 5.0% by yearend.

Market positioning seems much cleaner in the wake of the USD selloff since March. All told, evidence that the US economy has started to recover from the Q1 swoon could provide fresh impetus for the greenback to recover from its recent squeeze.

Some of these factors, and the attractive risk-reward presented by the aforementioned rally in EUR/USD were behind our team’s decision to go short EUR/USD last Friday targeting 1.0800.

*CA entered a short EUR/USD on Friday from 1.1385 targeting a move to 1.0800, with a stop at 1.1680.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.