Yet another deadline looms for Greece: the IMF payment due on June 5th. The Greek crisis is never too far from the headlines.

The team at NAB outline scenarios for both EUR/USD and AUD/USD:

Here is their view, courtesy of eFXnews:

1- Stay in Euro area and keep EUR (60%).

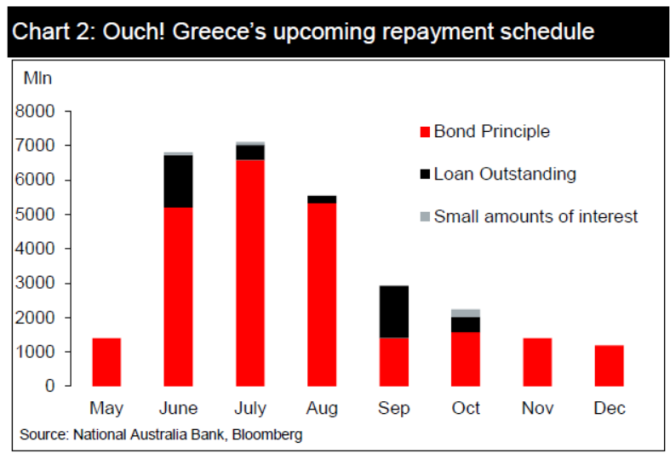

“The most likely scenario is the trodden path of scraping through; past the critical June-August period…Both sides may concede; Greece may do just the right amount to allow the IMF to provide them with funds. We then get through the biggest risk months of June to August and the pressure comes down,” NAB clarifies.

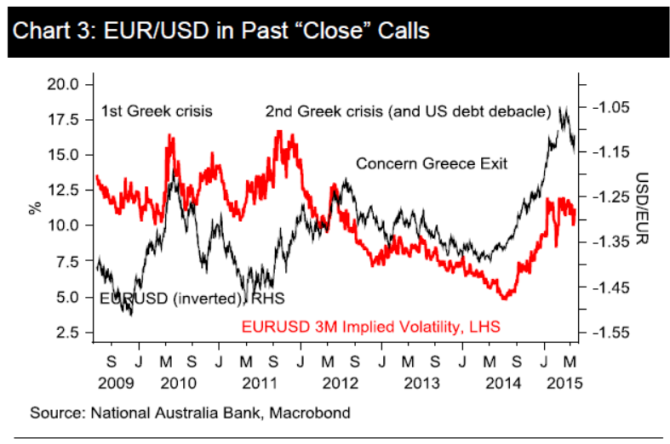

Impact: The EUR may fall 10% if concerns rise.

2- The less likely scenario is default but no EUR exit (30%).

“If neither side backs-down and Greece cannot be thrown out of the EZ/EU (according to the Lisbon Treaty) this then begs a question: Why not default on IMF/ECB payments and continue to use the Euro? This may not be in the spirit of being a good Euro Zone neighbour, but may offer a way of avoiding a painful exit that Greek citizens say they do not want,” NAB adds.

Impact: EUR falls at least 10%. AUD follows.

3- The least likely scenario is a Greek exit from the EUR (10%):

“If Greece did decide to leave the EUR, it would also have to leave the European Union. This would be extremely painful with significant adjustment to the banking, social security system and economy more broadly. The known, unknown in this particular case centres on the wider reaching effects,” NAB argues.

Impact: The EUR may fall 10-20%, AUD falls 10%; before recovery.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.