US dollar is mostly lower today as it consolidates and traders look for direction. With commodities higher and the dollar index lower, it appears that Forex traders are positioning themselves for what might be next. There hasn’t been a lot of meaningful economic data released recently, and that is impacting the greenback’s performance. Right now, the US dollar is in a state of consolidation, and is lower against many of its … “US Dollar Consolidates as Forex Traders Look for Direction”

Month: May 2015

AUD/USD: Trading the Chinese Industrial Production

Chinese Industrial Production is a key manufacturing indicator. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at 5:30 GMT. Indicator Background Traders should pay … “AUD/USD: Trading the Chinese Industrial Production”

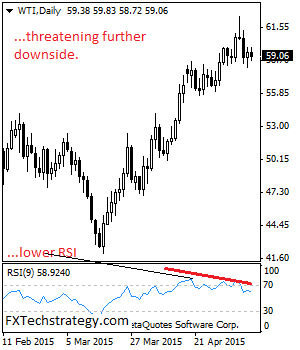

CRUDE OIL: Vulnerable On Loss Of Momentum

CRUDE OIL: Having Crude Oil rejected higher prices on negative candle formation the past week, it now looks to weaken on correction in the new week. On the upside, resistance resides at the 60.00 level where a break will expose the 61.00 level followed by the 62.00 level. A cut through here will aim at … “CRUDE OIL: Vulnerable On Loss Of Momentum”

Turkey at the Crossroads

Turkey is strategically located at the crossroads of the Arabian Peninsula, South Eastern Europe and Western Asia. Ports on the Black Sea and Mediterranean coast lines offer easy trade access to southern Europe, especially Greece and Italy, North Africa, the Middle East and Russia via the Kerch Straight. The IMF defines Turkey as an emerging … “Turkey at the Crossroads”

Pound Stronger After BoE Refrains from Action Again

The Great Britain pound rallied today against its major rivals following the decision by the Bank of England to leave its monetary policy unchanged. Such decision was widely expected as the central bank did not make any changes to the policy since 2009. The BoE announced today: The Bank of Englandâs Monetary Policy Committee at its meeting on 8 May voted to maintain Bank Rate at 0.5%. The Committee also voted to maintain the stock … “Pound Stronger After BoE Refrains from Action Again”

Yuan Little Changed After Surprise Interest Rate Cut

The Chinese yuan was little changed today after China’s central bank made a surprise interest rate cut. It was the third such move in the past six months, suggesting that Chinese policy makers are serious about rejuvenating the country’s economic growth. The People’s Bank of China lowered its main interest rate by 25 basis points to 5.1 percent over the weekend. It was just one of many … “Yuan Little Changed After Surprise Interest Rate Cut”

CAD: Rotation Emerges; EUR: Face-Off Against ECB – CIBC

The Canadian dollar enjoyed some significant volatility of late. IS it experiencing a “rotation”? EUR/USD experienced a nice rally, but could not keep up and dropped sharply. The team at CIBC explains the forces behind these currencies: Here is their view, courtesy of eFXnews: CAD: Rotation Starting to Emerge? Concerns surrounding the rotation of Canadian growth (towards … “CAD: Rotation Emerges; EUR: Face-Off Against ECB – CIBC”

Employment Situation Weighs on Canadian Dollar

Canadian dollar is lower today, thanks in large part to concerns over the employment situation and the economy. However, it’s also not helping that oil prices still aren’t recovering quite as much as some would like. Loonie is mostly lower today, falling even against the euro, which is struggling quite a bit today. Canadian dollar is being hit by an employment situation that is dragging on the economy. … “Employment Situation Weighs on Canadian Dollar”

Euro Struggles as Talks About Greece Cause Jitters

Euro is heading lower against its major counterparts today as continued talks about the situation with Greece add uncertainty and cause jitters. More Forex traders and others seem to be steeling themselves for a Greek exit from the eurozone. Once again, members of the Eurogroup are meeting to discuss the situation in Greece. Another payment on the IMF loan the country received is due tomorrow. Even though Greece is expected to pay, … “Euro Struggles as Talks About Greece Cause Jitters”

Taking tips from Yellen and lots more – Market Movers

Are stock markets facing a major sell-off? We analyze Yellen’s important words in a wide context, talk about the next moves for the Aussie and the C$ and preview next week’s interesting events. You are welcome to listen, subscribe and provide feedback. Yellen: It isn’t common for the Fed to comment on stock markets, but the comment about … “Taking tips from Yellen and lots more – Market Movers”