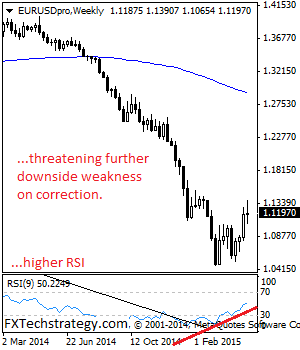

EURUSD: Having capped its strength at the 1.1390 level to close marginally lower the past week, corrective pullback threats are building up. Resistance is seen at the 1.1300 level with a cut through here opening the door for more downside towards the 1.1390 level. Further up, resistance lies at the 1.1450 level where a break … “EURUSD: Vulnerable On Corrective Threats”

Month: May 2015

3 reasons to go long USD on the NFP

The US gained 223K jobs in April, within expectations, but the data was mixed. The mixed data triggered a very mixed reaction in markets, with the dollar jumping up and down. Diving into the details of the report, we can find more positives than negatives. Will the dollar rise after the dust settles? Here is the case, … “3 reasons to go long USD on the NFP”

US Dollar Index Gains as Traders Await Jobs Report

US dollar index is higher today as traders wait for the release of the nonfarm payrolls report from April. Dollar is mixed against individual currencies. The US dollar is mixed against individual currencies right now, gaining against the euro and the yen, but down against the pound. Greenback has also slipped against the loonie on the higher price of oil today. Even so, the dollar index is trading higher, thanks … “US Dollar Index Gains as Traders Await Jobs Report”

Conservative Win Propels UK Pound Higher

UK pound is surging today, thanks to the probable win for the Conservatives. It looks as though David Cameron is likely to remain Prime Minister, and that is leading to strong support for the sterling across the board. Financial markets in the United Kingdom are celebrating the likely Conservative majority in Parliament. It looks as though the outcome of the UK elections will be David Cameron remaining Prime Minister. The FTSE 100 is much higher … “Conservative Win Propels UK Pound Higher”

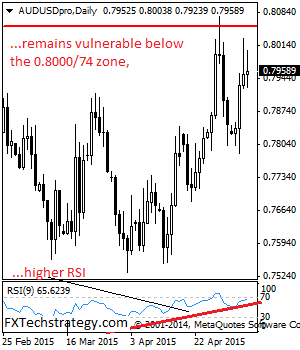

AUD/USD: Vulnerable Below The 0.8000/74 Zone

AUDUSD: With the pair facing price hesitation ahead of its key resistance at the 0.8000/0.8074 zone, it could turn lower if that zone continues to hold. On the downside, support resides at the 0.7900 level where a breach will aim at the 0.7850 level. Below that level will set the stage for a run at … “AUD/USD: Vulnerable Below The 0.8000/74 Zone”

GBP: Trading The UK Elections – Credit Agricole

The UK elections are very tight and the impact of the results could be seen in GBP for quite some time. Here is the assessment from Credit Agricole: Here is their view, courtesy of eFXnews: GBP-crosses remain stuck in ranges suggesting there is no strong market view on the pound ahead of the elections. With polls still … “GBP: Trading The UK Elections – Credit Agricole”

Aussie Struggles After Rate Cut, Employment Data

After moving above the US80¢ earlier, the Australian dollar is struggling. Thanks to disappointing employment data and a rate cut earlier this week, the Aussie is feeling a little weak against some of its counterparts. Earlier this week, the Reserve Bank of Australia cut the cash rate to 2 per cent. There have been concerns about the Australian economy since gold prices have been low and since growth is slowing … “Aussie Struggles After Rate Cut, Employment Data”

Euro Continues Run in Forex Trading

Euro has been enjoying a run of relative strength in recent days, and today is no different. Evidence that maybe the ECB didn’t need to be quite so aggressive with quantitative easing, as well as better feelings about the Greece situation, have been supporting the 19-nation currency. Euro is higher almost across the board today as its performance continues to show strength. After almost falling to parity in April, the euro … “Euro Continues Run in Forex Trading”

EUR/USD: Trading the US NFP May 2015

US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls: +223K – as expected Published … “EUR/USD: Trading the US NFP May 2015”

4 Reasons The USD Will Rebound – Keep The Faith – BNPP

The past week has not been a good week for USD bulls, and more specifically EUR/USD bears. Is all lost? The team at BNP Paribas gives 4 reasons to keep the faith: Here is their view, courtesy of eFXnews: “Against expectations, the FOMC announcement this week was less of a marketmoving event than the earlier release … “4 Reasons The USD Will Rebound – Keep The Faith – BNPP”