The British Services PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the services sector. Respondents are surveyed for their view of the economy and business conditions in the UK. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published … “GBP/USD: Trading the British Services PMI May 2015”

Month: May 2015

EUR/USD: Trading the ISM Services PMI May 2015

The ISM Non-Manufacturing PMI (Purchasing Manager Index) is based on a survey of purchasing managers in sectors other than manufacturing. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than expected is bullish for the dollar. Here are all the details, and 5 possible outcomes … “EUR/USD: Trading the ISM Services PMI May 2015”

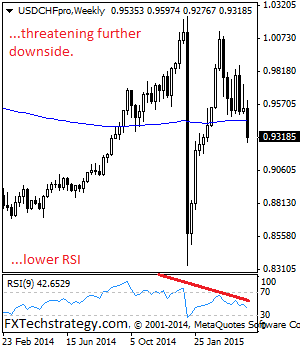

USDCHF: Sells Off On Loss Of Upside Momentum

USDCHF: Having USDCHF declined strongly the past week, it could extend that weakness in the new week. On the downside, support comes in at the 0.9250 level. A turn below here will open the door for more weakness to occur towards the 0.9200 level and then the 0.9150 level. A cut through here will open … “USDCHF: Sells Off On Loss Of Upside Momentum”

Did the market get it right on the Fed’s hike?

The Fed does not seem extremely worried of the US slowdown. This was perceived as hawkish but rate hike expectations remained low. What’s going on here? We explain everything and also discuss the upcoming market movers and shakers. You are welcome to listen, subscribe and provide feedback. State of the Fed: Blaming the weather is a game the … “Did the market get it right on the Fed’s hike?”

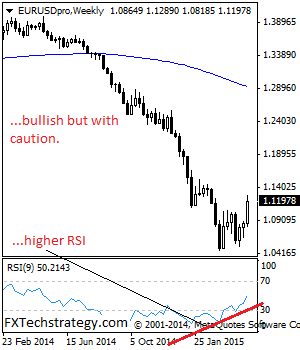

EURUSD May 4 2015 analysis Bullish With Caution

EURUSD: Although EUR may be biased to the upside on the weekly chart, its price action on the daily chart is suggestive of a move lower on correction. This development leaves risk lower in the new week. Resistance is seen at the 1.1289 level with a cut through here opening the door for more downside … “EURUSD May 4 2015 analysis Bullish With Caution”

The ECB’s QE Prescription, And Its Side Effects –

The euro currently seems to ignore the ongoing ECB QE program and continues rising and rising. The QE program has more consequences. Here is the view from Goldman Sachs: Here is their view, courtesy of eFXnews: Low Rates in Europe are the Symptom of ‘Low-flation’: “Low, or negative, bond yields are now more the norm than … “The ECB’s QE Prescription, And Its Side Effects –”

Is This The End Of EUR-Funded Carry Trades? – Credit

With EUR/USD showing a lot of strength, it is time to ask whether one of the drivers lower has materially changed, especially as bunds have changed course. Here is the take from Credit Agricole: Here is their view, courtesy of eFXnews: EUR remains surprisingly resilient as investors worry that the ECB may taper its QE before long … “Is This The End Of EUR-Funded Carry Trades? – Credit”

EUR/USD: A Buy Signal Or A Warning Signal- JP Morgan,

EUR/USD continues defying gravity, continuing higher when other currencies slip against the dollar. Here are two different opinions on what’s next for euro/dollar: Here is their view, courtesy of eFXnews: JPM: The bears are on alert, but remain in control for the time-being. “The break above pivotal resistance at 1.1053/98 sent a first serious warning signal … “EUR/USD: A Buy Signal Or A Warning Signal- JP Morgan,”

Forex Crunch Key Metrics April 2015

The fourth month of the year began slowly with the Easter break but certainly accelerated towards the end. All in all, while there is a drop from March, the year over year figures show a gain of 62% in page views. May is usually one of the strongest months of the year, so we hope for better … “Forex Crunch Key Metrics April 2015”

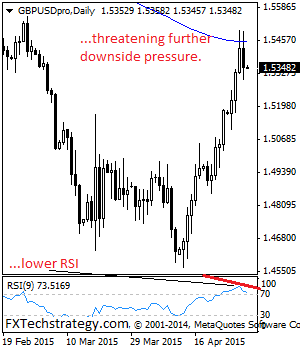

GBPUSD: Weakens On Correction

GBPUSD: GBP weakened on Thursday leaving risk of a move further lower on the cards. On the upside, resistance resides at the 1.5400 level with a break aiming at the 1.5450 level. A violation will aim at the 1.5500 level and possibly higher towards the 1.5550 level. On the downside, support lies at the 1.5300 … “GBPUSD: Weakens On Correction”