Is the sell off of the USD finally over? It may be the case. The team at Credit Agricole see the greenback at a turning point and a short opportunity for EUR/USD: Here is their view, courtesy of eFXnews: The USD kicked off the week on a strong note, rising against all major currencies. The EUR … “USD Turning Point: Stay Short EUR/USD For 1.08 – Credit”

Month: May 2015

Canadian Dollar Falls as Oil Slides

Canadian dollar is mostly lower again today, thanks to the slide in oil prices. The loonie is struggling as oil, once again, falls away from the $60 a barrel mark. The Canadian economy is very dependent on oil prices, and the fact that oil is falling against isn’t helping the loonie today. Oil is down more than $2 per barrel on the day, and is likely to continue to fall in the near term. … “Canadian Dollar Falls as Oil Slides”

GBP/USD: Trading the British Retail Sales May 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary gauge of consumer spending, a critical component of economic … “GBP/USD: Trading the British Retail Sales May 2015”

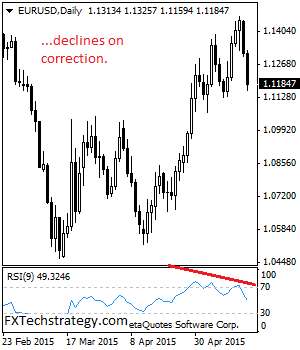

Technical analysis: EURUSD: Remains Weak May 20 2015

EURUSD: With EUR seen weakening for a second day in a row, further bearishness is envisaged in the days ahead. Support lies at the 1.1150 level where a breach will aim at the 1.1100 level. Below here if seen will turn attention to the 1.1050 level where a violation will aim at the 1.1000. The … “Technical analysis: EURUSD: Remains Weak May 20 2015”

Euro Goes Lower on ECB Bond Purchases & German Business Sentiment

The euro dropped today against its major rivals due to a report that the European Central Bank will expand its bond purchases. Poor economic data from Germany also drove the shared 19-nation currency down. ECB Executive Board member Benoit Coeure said the central bank would buy more securities in May and June. He explained that the reason for such decision is the “notably lower market liquidity.” … “Euro Goes Lower on ECB Bond Purchases & German Business Sentiment”

US Housing Data Fuels Upside Momentum of Greenback

US housing data released today impressed analysts, beating even optimistic forecasts. It allowed the US dollar to gain for the second straight session against the euro and for the third session versus the Great Britain pound and the Japanese yen. Both US housing starts and building permits rose at the seasonally adjusted annual rate of 1.14 million in April, and both indicators exceeded forecasts. Housing starts were at the highest level since December 2007 … “US Housing Data Fuels Upside Momentum of Greenback”

RBA Minutes Have Limited Impact on Australian Dollar

The Australian dollar fell against its US counterpart today after the Reserve Bank of Australia released minutes of its May policy meeting, during witch the central bank has cut interest rates. Yet the drop was not big, and the Aussie actually managed to gain on the euro. The minutes showed that the RBA staff was not as optimistic about economic growth as it has been previously: Although the recent flow of data … “RBA Minutes Have Limited Impact on Australian Dollar”

Pound Slumps as Great Britain Enters Deflation

The Great Britain pound tumbled today as the United Kingdom has entered deflation for the first time in more than 50 years. The currency had been moving mostly sideways ahead of the report. The annual drop of the UK Consumer Price Index in April was not big — just 0.1 percent. Yet it was the first time when the UK entered deflation since 1960. The very negative report led to the third straight daily … “Pound Slumps as Great Britain Enters Deflation”

US Dollar Strengthens on Likely Policy Divergence

US dollar is heading higher today, strengthening on likely policy divergence with European currencies. Greenback is gaining support as economic data in other regions sour and as commodities fall back. The latest news out of the United Kingdom is that deflation is taking hold. With expectations that the Bank of England will have to continue easing policies, the dollar is likely to retain its strength against the sterling. In the eurozone, the European … “US Dollar Strengthens on Likely Policy Divergence”

Deflation Sends the UK Pound Lower

After showing strength on the heels of the recent election in the United Kingdom, the pound is now weakening. The latest inflation data is in, and it appears that deflation is affecting the sterling. UK pound saw gains following the recent election. With a victory for the party in power, many saw the election as a way to maintain the status quo, providing the certainty that many crave in these times. This helped boost sterling. Now, though, … “Deflation Sends the UK Pound Lower”