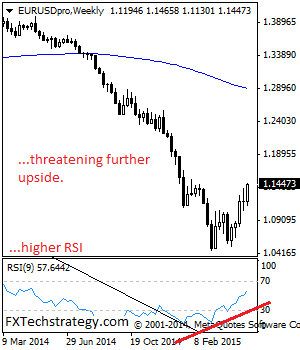

EURUSD: Having rallied to close above the 1.1390 level the past week, risk of further upside is likely in the new week. However, you should keep your eyes on the 1.1449 and the 1.1533 zone where strong resistance levels are located. Resistance is seen at the 1.1533 level with a cut through here opening the … “EURUSD: Maintains Upside Offensive”

Month: May 2015

Rate Hike Speculation Helps Canadian Dollar

There is speculation that the Canadian dollar is strong enough now that a rate hike from the Bank of Canada could come sooner than expected. The news is helping the loonie against its European counterparts. Even though the Canadian dollar is lower than its US counterpart, the loonie is seeing some gains today. The Canadian dollar is stronger against the UK pound and euro, thanks to speculation … “Rate Hike Speculation Helps Canadian Dollar”

Euro Slips Below 1.1400 Against US Dollar

Euro is slipping today, losing ground after a rally earlier in the session. This happened toward the end of last week as well. After a strong run, the 19-nation currency is starting to show signs of weakness. Euro is losing ground to its major counterparts right now, even though the 19-nation currency was mostly higher earlier in the session. Last week, the euro ended higher — even though the currency was lower … “Euro Slips Below 1.1400 Against US Dollar”

USD/JPY: Trading the Japanese GDP May 2015

Japanese Preliminary GDP measures production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity, and a reading which is better than the market forecast is bullish for the Japanese yen. Here are all the details, and 5 possible outcomes for USD/JPY. Published on Wednesday at 23:50 GMT. Indicator Background … “USD/JPY: Trading the Japanese GDP May 2015”

USD: Glass half full or half empty? – Market Movers #50

Lots of ins and out in the US labor market situation. When will the rate hike come? We offer both sides of the argument, talk about the implications of the UK election results, the situation of oil prices and preview the next week’s events in a volatile market. You are welcome to listen, subscribe and provide feedback. UK … “USD: Glass half full or half empty? – Market Movers #50”

USD/CAD Probes Support; EUR/USD Back To The Drawing Board

Dollar/CAD and also EUR/USD experienced interesting technical moves in the past week. What does the road ahead have for them? The team at Bank of America Merrill Lynch provides some insight: Here is their view, courtesy of eFXnews: USD/CAD is testing pivotal long-term support at the 1.1909/1.1915 area, notes Bank of America Merrill Lynch. “While … “USD/CAD Probes Support; EUR/USD Back To The Drawing Board”

Dollar Among Biggest Losers During Trading Week

The US dollar was one of the weakest currencies on the Forex market during the past trading week, competing with the New Zealand dollar and the Japanese yen for the place of the biggest loser. Meanwhile, the euro and the Great Britain pound were the two strongest currencies. As it has been happening lately, the US currency was hurt by poor economic reports from the United States. Stagnating retail sales and deflation of producer prices were had the biggest … “Dollar Among Biggest Losers During Trading Week”

GBP: The Calm After The Storm; How To Position? – BNPP

The pound has certainly moved higher, continuing its post-election rally, despite mixed events. Could it be entering a period of calm? The team at BNP Paribas explains: Here is their view, courtesy of eFXnews: With the outcome of the UK election much ‘cleaner’ than expected, BNP Paribas believes a return to fundamentals warrants a more positive view … “GBP: The Calm After The Storm; How To Position? – BNPP”

Japanese Yen Falls, Attempts to Bounce

The Japanese yen fell today as Japan’s producer prices dropped in April from a year ago, highlighting the problems that the central bank has in its battle with deflation. The currency trimmed its gains against some majors and actually gained against the euro but maintained losses versus the US dollar. While the Corporate Goods Price Index showed a small increase by 0.1 percent in April from the previous month, the index dropped … “Japanese Yen Falls, Attempts to Bounce”

Great Britain Pound Falls vs. Dollar, Retains Strength vs. Other Majors

The Great Britain pound pulled back from the six-month high against the US dollar as the greenback made a bounce. Still, the UK currency gained against other majors, including the euro. The sterling was the strongest major currency on the Forex market during the current week and retained its upward momentum despite the small retreat against the dollar. The UK currency managed to keep its strength against other most-traded rivals, like the Japanese yen … “Great Britain Pound Falls vs. Dollar, Retains Strength vs. Other Majors”