Euro has moved lower today, but the 19-nation currency is still poised for weekly gains. The rise in German Bund yields has stalled, and Forex traders are taking this opportunity to take profits and consolidate. This past week has seen a surging performance for the euro in Forex trading. The 19-nation currency has been gaining against most of its major counterparts as yields on German Bunds have risen. Now, though, … “Euro Lower, But Poised for Weekly Gains”

Month: May 2015

Aussie Pulls Back After Earlier Gains

Australian dollar is paring some of its earlier gains right now, which should be a relief to the Reserve Bank of Australia, which has been trying to encourage a weaker Aussie for the sake of economic stimulus. Australian dollar moved higher yesterday and was higher in earlier trading. However, the Down Under currency has since pared some of its gains and is once again mostly lower against many of its counterparts. Disappointing news … “Aussie Pulls Back After Earlier Gains”

Dollar’s Down Move Regains Momentum

While the US dollar has been going to new lows during the Thursday’s trading session, it looked like the downward move is running out of steam, allowing the currency to trim some of its losses. Yet currently the greenback resumed its move down. The dollar was falling initially during the current session, and reached the lowest level since November 27 against the Great Britain pound and the weakest since February 19 … “Dollar’s Down Move Regains Momentum”

Decline of Crude Oil Leads to Losses for Canadian Dollar

The Canadian dollar fell against other majors during the current trading session, largely due to the drop of crude oil prices. The currency fell even against the US dollar despite the earlier rise to the highest level since January. Futures for crude oil traded 1.12 percent lower at $59.82 per barrel in New York today. Prices were under pressure from oversupply on the market. The bounce of the US currency after the initial drop … “Decline of Crude Oil Leads to Losses for Canadian Dollar”

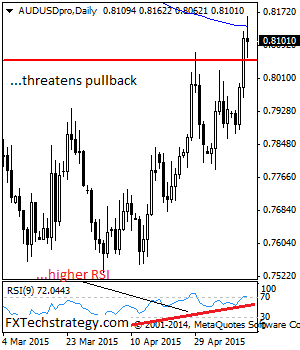

AUDUSD: Faces Price Hesitation, Threatens Pullback

AUDUSD: With price hesitation setting in and halting its recovery started off the 0.7862 level, a move back lower could be building up. On the downside, support resides at the 0.7963 level where a breach will aim at the 0.7900 level. Below that level will set the stage for a run at the 0.7862 level … “AUDUSD: Faces Price Hesitation, Threatens Pullback”

EUR/USD: Trading the UoM Consumer Sentiment Index – May

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US consumer Confidence falls to 88.6 – USD lower Here are all the details, and 5 possible … “EUR/USD: Trading the UoM Consumer Sentiment Index – May”

Bond Yields Continue to Help Euro

Bond yields in the eurozone continue to surge, and that is helping the euro right now. The 19-nation currency is heading higher against the US dollar and some of its other counterparts as yields and economic news provide support. The euro hit a three-month high against the US dollar earlier, thanks in large part to surging eurozone government bond yields. Stocks are still on the defensive, and the euro is gaining ground. Also helping the 19-nation currency … “Bond Yields Continue to Help Euro”

Retail Sales Weigh on the US Dollar

US dollar is struggling today, thanks in large part to the poor retail sales data report for April. The report provides more evidence that the US economic recovery is losing steam, and that is leading to a greenback that is mostly lower in Forex trading. Analysts expected retail sales to increase by 0.3 per cent in the month of April, but they remained flat. Consumers appear reluctant to spend, and with a large … “Retail Sales Weigh on the US Dollar”

EUR/USD: An Early Warning Signal – Danske

EUR/USD rallied hard on the poor US retail sales report. What’s next for the pair? The team at Danske explain the current situation and provide forecasts for 1m, 3m, 6m and 12 months. Here is their view, courtesy of eFXnews: Deflation deceleration warns of EUR/USD upside later… − Stretched positioning in terms of ‘long USD’ made … “EUR/USD: An Early Warning Signal – Danske”

Pound Retains Strong Upward Momentum

The Great Britain pound extended its move upward today, rising to the highest level since November against the US dollar and gaining versus the Japanese yen. Today’s economic data was supportive for the currency while yesterday’s news was not so much. Today, Royal Institution of Chartered Surveyors reported that the house price balance was at the +33 mark, far above the median forecast of +22 and exceeding even the most optimistic … “Pound Retains Strong Upward Momentum”