Economic data from New Zealand was mixed today. While the NZ dollar rallied initially as traders paid more attention to the good part of the news, the currency retreated as of now, though it is still trading above the opening level. New Zealand retail sales rose 2.7 percent during the first quarter of the year, exceeding market expectations of 1.6 percent growth. It was the biggest percentage increase since December … “NZ Dollar Backs Off After Initial Rally”

Month: May 2015

3 Reasons To Stay Long GBP – Deutsche Bank

The pound has certainly had its share of action, with significant intra-day drops and rises. What’s next for sterling? The team at Deutsche Bank lists 3 reasons to remain long: Here is their view, courtesy of eFXnews: In a special note today, Deutsche Bank advises clients to stay long GBP, arguing that there is still value … “3 Reasons To Stay Long GBP – Deutsche Bank”

New Zealand Dollar Rallies After Poor US Data

The New Zealand dollar rallied today on the back of the US dollar’s weakness even though news from the South Pacific nation itself was rather detrimental to the kiwi. US retail sales were flat in April, frustrating market participants who counted on an increase. This led to jump of the New Zealand dollar against its US counterpart as well as versus other majors. The kiwi was rising earlier as well even though the currency … “New Zealand Dollar Rallies After Poor US Data”

GDP News Helps Euro

Euro is heading higher against many of its major counterparts today, thanks in part to a new GDP reading. Better economic data is helping the euro, even though there are still trials to overcome. The eurozone economy grew by 0.4 per cent in the first quarter of 2015, according to the latest news from Eurostat. The agency reports that GDP rose on a seasonally adjusted basis, building on the 0.3 per cent growth … “GDP News Helps Euro”

Oil Rally Lifts Loonie Higher in Forex Trading

Oil is rallying, and that is helping the Canadian dollar in Forex trading today. Loonie is mostly higher against its major counterparts. Oil continues to rally today, moving above $61 per barrel as concerns about global unrest, as well as forecasts for increased demand, provide support. The fighting still going on in Yemen is threatening supply out of the Arabian peninsula, and that is providing some support for oil. Another … “Oil Rally Lifts Loonie Higher in Forex Trading”

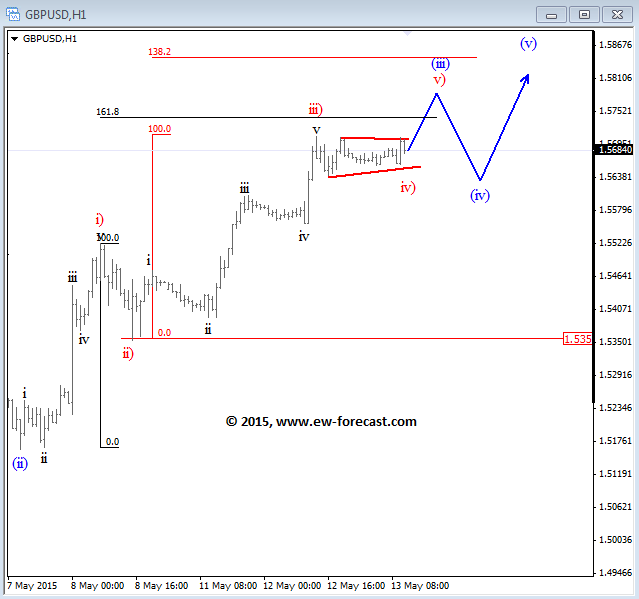

GBPUSD could halt at 1.58; USDCHF Looks For Support –

GBPUSD keeps trading higher, so we adjusted the wave count. We are now looking at an impulsive recovery, currently with subwave (iii) in progress, but it may be trading now into the final stages with its five subwaves. That said, an upside move can be limited near 1.5800. GBPUSD 1h Elliott Wave Analysis USDCHF price … “GBPUSD could halt at 1.58; USDCHF Looks For Support –”

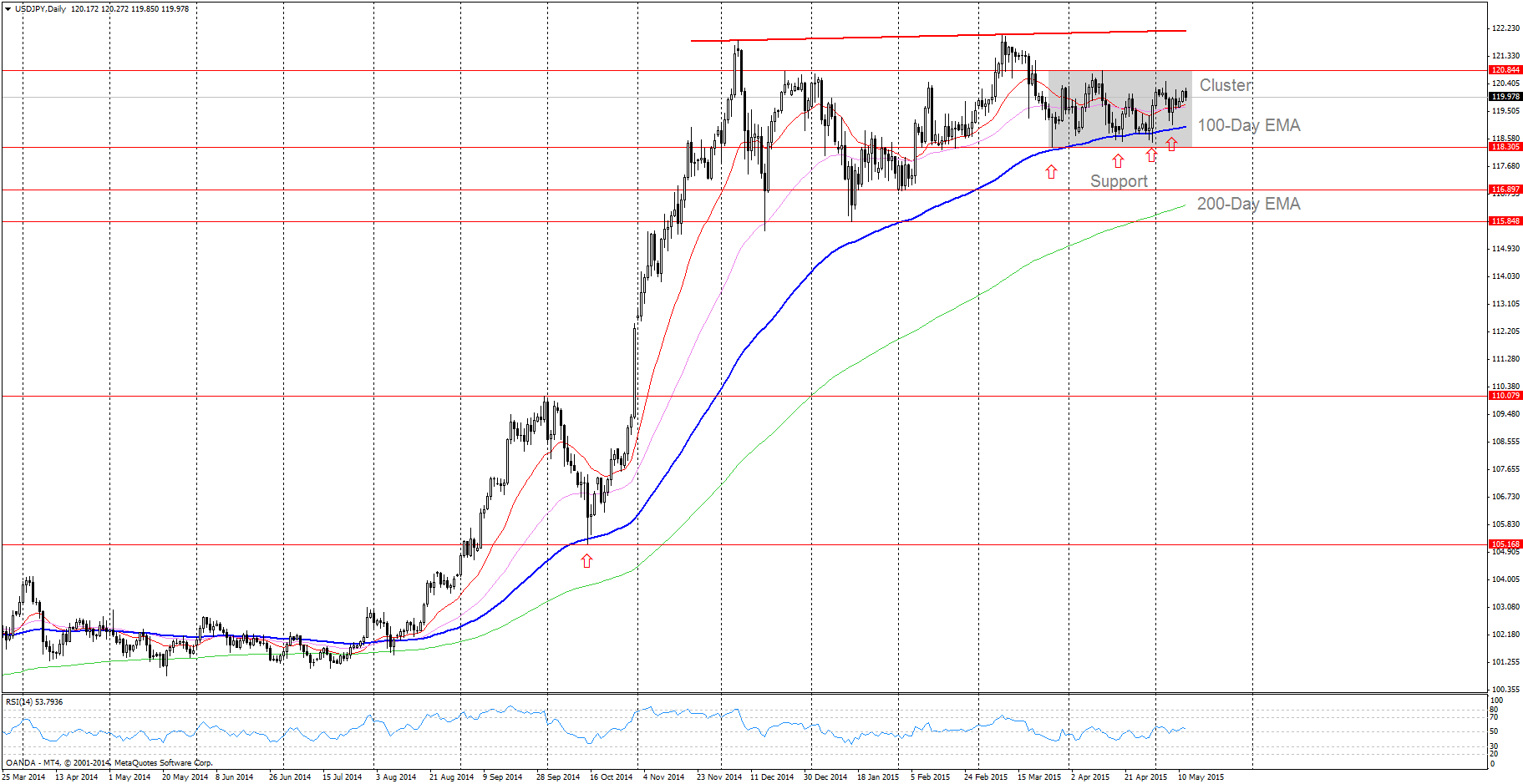

USD/JPY in Large Trading Range above 100-Day EMA

USD/JPY (daily chart as of May 12, 2015) has been trading in a large range since December 7, 2014. The range can be defined as an area between a rising resistance line (connecting the December 7, 2014 high and March 9, 2015 high – bold red line on chart) and its 100-day EMA (bold blue … “USD/JPY in Large Trading Range above 100-Day EMA”

New Zealand Dollar Struggles to Keep Gains

The New Zealand dollar is struggling to keep its earlier gains against the US dollar and the Japanese yen during the current trading session. While the currency rallied initially today, it is moving down as of now, trading dangerously close to the opening level. Traders wait for the Financial Stability Report from the Reserve Bank of New Zealand that will be released at the beginning of the Wednesday’s trading session. The report will be followed … “New Zealand Dollar Struggles to Keep Gains”

Sterling Remains Strongest with Help of Positive Data

The Great Britain pound continued to rally to new highs today, following yesterday’s strong performance, thanks to the positive macroeconomic data from the United Kingdom. In fact, the sterling is the strongest major currency so far this week. British Retail Consortium reported that retail sales fell in April fro a year ago. Yet the reading was distorted by the Easter holiday, while the 3-month moving average, which removes the distortion, demonstrated … “Sterling Remains Strongest with Help of Positive Data”

Low-Risk Bonds Sell Off, Sending Euro Higher

Euro is surging in Forex trading today as low-risk bonds sell off today. The sell-off in low-risk bonds is weighing on European stocks and helping the 19-nation currency gain ground against its major counterparts. As the US dollar consolidates, the euro is getting a little extra help from a sell-off in low-risk bonds. Bonds that carry low risk, like US Treasuries and German Bunds, are selling off, weighing on global … “Low-Risk Bonds Sell Off, Sending Euro Higher”