EUR/USD certainly had a wild ride of around 400 pips before stabilizing on high ground.

Nevertheless, the team at BNP Panibas calls us to fade the strength and provides 6 reasons:

Here is their view, courtesy of eFXnews:

BNP Paribas exited its latest short EUR/USD position this week following the market’s response to the ECB’s press conference.

However, in its FX weekly note to clients today, BNPP reiterates its bearish EUR/USD view, outlining 6 key reasons for fading the recent EUR/USD strength, albeit with caution on current volatility. The following are a list of these reasons along with BNPP latest forecasts for EUR/USD.

1- The ECB’s message remains dovish. “The ECB’s message was dovish overall, with President Draghi reaffirming the central bank’s firm intention to implement its full programme of asset purchases despite recent improvement in inflation data,” BNPP notes.

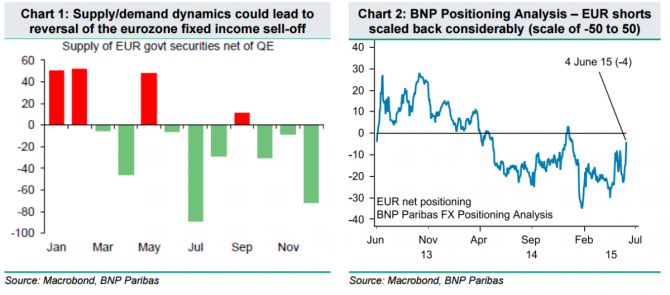

2- The bonds market’s selloff is likely to reverse. “The rise in EURUSD over this week went hand-in-hand with the sell-off in European bonds. Our interest rate strategy team highlight that the net supply picture is better for European bonds as we move into the summer months and expect better performance ahead,” BNPP projects.

3- EUR positioning is very close to neutral levels. “The short squeeze in the EUR appears to have largely run its course according to our positioning analysis,” BNPP adds.

4- EURUSD has converged back in line with its STEER. “Now that the exchange rate is trading close to its fair value, the pair could respond to an improvement in US yields if the US data flow picks up as we expect,” BNPP argues.

5- Robust US data should provide fundamental support for the USD. “We view that a strong payrolls report (our economists expect an above-consensus 240k gain) would go a long way in setting up the stage for a change in the Fed message, eventually guiding the markets to a September rate hike and boosting US yields,” BNPP projects.

6- Positive Greek news unlikely to prevent EURUSD weakness. “On Greece’s situation, we view that a ‘resolution’ by the end of this month does not warrant a shift of the view on the EUR,” BNPP adds.

EUR/USD forecasts:

BNPP maintains its EUR/USD forecasts at 1.04 by the end of Q2, 1.02 the end of Q3, and 1.0 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.