EUR/USD is experiencing significant jitters in recent decent, moving on Greece, monetary policy divergence and many other factors.

What’s behind the squeeze? The team at Credit Suisse explains with 3 charts:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients, Credit Suisse discuses the drivers behind the ongoing squeeze in EUR/USD. CS concludes by outlining its current strategic standing on EUR/USD from a risk-reward perspective, along with its latest forecasts.

EUR/USD: Behind The Squeeze.

CS thinks a number of short-term factors contributed to this rapid retracement in the USD, especially against the EUR.

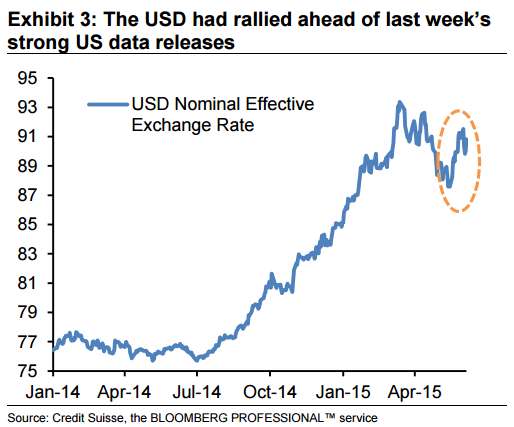

1- “The USD had rallied sharply ahead of last week’s data releases. This coincided with the end of the consolidation period triggered by the Fed’s dovish message at the 18 March meeting. As such, we think profit taking and position squaring have likely underscored the USD pullback of the past few days,” CS notes.

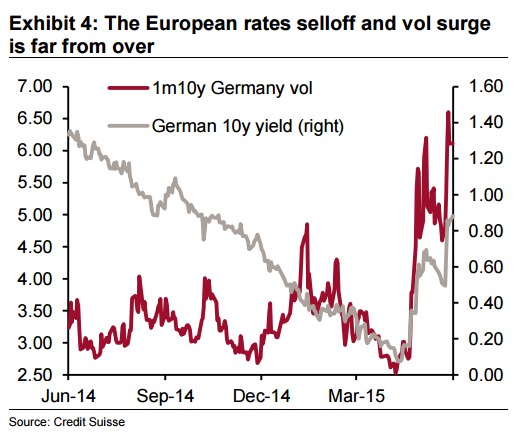

2-“The ongoing selloff in European rates likely provided some support for EURUSD. While the ongoing nature of the rates selloff might have somewhat lessened the focus of financial media on price action in European bond markets, neither yields nor implied volatilities have eased materially. Ongoing uncertainty surrounding the outcome of negotiations between core European and Greek officials is likely one the driving factors on this front,” CS argues.

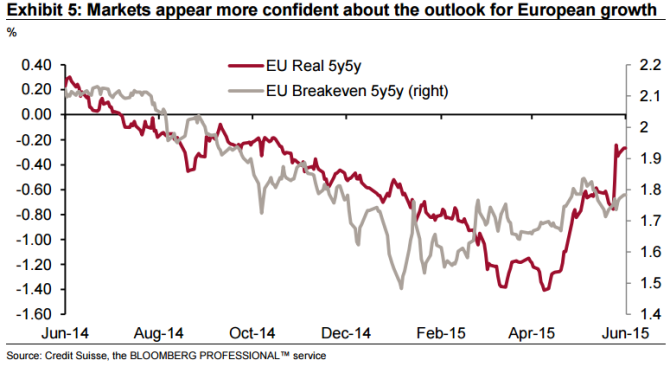

3- “Markets appear to be finally more confident in the impact of the ECB’s QE policy on the outlook for growth and for inflation expectations, as suggested by the ongoing pick up in 5y5y European real rates and inflation breakevens,” CS adds.

EUR/USD: ECB Inflation Expectations.

“The above developments, especially on rates front, are likely closely related to the outcome of last week’s ECB meeting. While ECB President Draghi restated the openended nature of the QE program in attempt to stem expectations of a “tapering” event, the bank also revised its HICP and core inflation expectations slightly higher, casting what we believe is an overly optimistic outlook for the European economy,” CS notes.

“We think the ECB will likely have to revise its inflation forecasts lower in the coming months,with dovish implications for policy expectations, and bearish implications for EURUSD. This said, we think it might be several weeks before this happens,” CS projects.

EUR/USD: Risk/Reward.

“As such, while we remain bearish on EURUSD, we do not think being outright long USD against the EUR is most attractive risk-reward proposition in FX at the moment,” CS advises.

EUR/USD: Forecasts.

After a period of consolidation, CS thinks EUR/USD will revert to its downtrend as diverging monetary policy comes to focus between EUR easing and a still eventually hiking Fed.

CS maintains its EUR/USD forecasts at 1.05 in 3-months and 0.98 in 12 months.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.