The US dollar is struggling with negative data and does not really rally on positive data.

What’s going on? And will this change? The team at CIBC weighs in:

Here is their view, courtesy of eFXnews:

Economic data has been solid over the past month and the US recovery looks like it’s back on track but the currency is barely treading water against other majors, notes CIBC World Markets.

So what’s wrong with the USD?

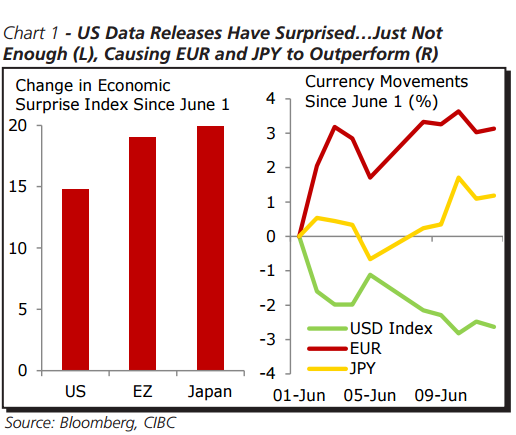

“It’s certainly not the domestic economy. Payrolls were way ahead of consensus, retail sales revealed that the US consumer was out spending as early as March and the ISM manufacturing index suggested that new orders were growing. The headwinds facing the US dollar have instead come from factors supporting foreign currencies (and the somewhat dovish interest rate projections from the Fed), which have outweighed the effects of strong US data,” CIBC argues.

“In the euro area, economic data has surprised to the upside to an even greater extent than in the US. As a result of the positive data and the sharp normalization of extremely low yields, the EUR has performed well against the USD,” notes.

“It’s a similar story for the yen as Japanese data releases have surprised investors. But the yen also caught a bid after the Governor of the BoJ made statements suggesting that he didn’t believe the currency would depreciate much further against the US dollar,” CIBC adds.

“Going forward, we expect markets to change their tune. With the US recovery on firmer ground, a September rate hike by the Fed remains our forecast. That should lift US yields and cause the spread between Treasuries and Bunds/JGBs to widen again. So we expect the USD to shrug off some of these more idiosyncratic factors, and make one more move higher around the time of the first rate hike,” CIBC projects.

CIBC sees EUR/USD trading at 1.05 by the end of Q3 and at 1.08 by the end of the year.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.