Reports over the weekend suggest that there is some progress around the Greek crisis. Will we see a deal soon?

If so, the team at BNP Paribas suggests fading any Greek related rally. Here is their rationale:

Here is their view, courtesy of eFXnews:

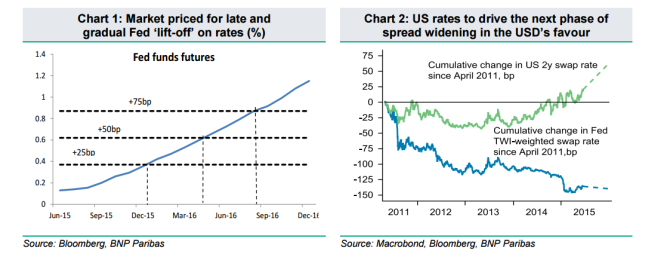

“Despite a dovish market reaction to this week’s FOMC statement, the Fed’s message remains focused on data dependency, and our economists continue to believe that conditions will be met for policy tightening to start in September. Accordingly, markets should remain focused on upcoming US economic releases.

In the week ahead, a rebound in May core durable goods orders would be encouraging after a downward revision to April data, while the personal income and spending report should echo the improvement in retail sales data. We remain USD bulls but recommend positioning through option structures with limited upside potential given the Fed’s sensitivity to dollar strength.

The coming days may be the final opportunity for some sort of Greek deal to be agreed ahead of the end-June deadline. Reading EUR moves around Greek headlines remains complicated by the EUR’s funding currency status. Our preference is still to fade any rallies on a Greek ‘resolution’ as we believe it would ultimately lead to investors regaining appetite for shorting the EUR against pro-risk currencies.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.