The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Update: US Consumer Confidence: 94.6 – above expectations Here are all the details, and 5 possible outcomes for … “EUR/USD Trading the Consumer Sentiment Index June 2015”

Month: June 2015

Greek Crisis: Happy End in Sight – New “Hard” Deadline

The reported willingness of Germany to compromise and settle for only one reform for now probably leads the way to an agreement between Greece and its creditors in the upcoming days. While June 30th is when the current bailout ends and also the IMF bundled payment is due, a hurdle worth double that amount awaits on July 20th – … “Greek Crisis: Happy End in Sight – New “Hard” Deadline”

EUR/USD Risk/Reward: What’s Behind The Squeeze? – Credit Suisse

EUR/USD is experiencing significant jitters in recent decent, moving on Greece, monetary policy divergence and many other factors. What’s behind the squeeze? The team at Credit Suisse explains with 3 charts: Here is their view, courtesy of eFXnews: In its weekly FX note to clients, Credit Suisse discuses the drivers behind the ongoing squeeze in … “EUR/USD Risk/Reward: What’s Behind The Squeeze? – Credit Suisse”

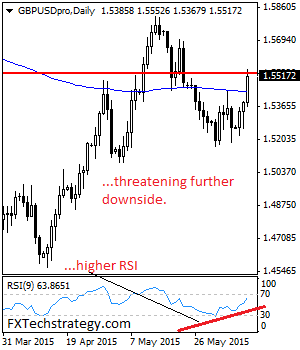

GBPUSD June 10 2015: Bullish, Eyes Further Upside

GBPUSD: Having followed through higher on Wednesday, further bullishness is envisaged. This development leaves the pair targeting further upside towards the 1.5600 level where a break will aim at the 1.5650 level followed by the 1.5700 level. A break will target the 1.5750 level where a violation will aim at the 1.5550 level and possibly … “GBPUSD June 10 2015: Bullish, Eyes Further Upside”

Merkel Blinks on Greece – Germany’s turn to lose 7:1

As the clock is ticking, it seems that German Chancellor Angela Merkel is willing to make a significant compromise, at least in order to push back the deadline for now. This also comes as outflows from Greek banks intensify, and the ECB is experiencing increased exposure. According to reports, Germany is willing to accept only one … “Merkel Blinks on Greece – Germany’s turn to lose 7:1”

Aussies Ignores Negative Domestic Fundamentals, Still Falls vs. Yen

The Australian dollar gained against its US counterpart today even though news from Australia was not supportive for the currency at all. The Aussie, as well as its other major peers, fell against the Japanese yen. The WestpacâMelbourne Institute Index of Consumer Sentiment fell 6.9 percent in June from May after rising 6.4 percent a month ago. On top of that, Glenn Stevens, Governor of the Reserve Bank of Australia, suggested in today’s … “Aussies Ignores Negative Domestic Fundamentals, Still Falls vs. Yen”

Japanese Yen Soars After Kuroda’s Comments

The Japanese yen soared against the US dollar, climbing more than 1 percent, after the comments from central bank’s chief Haruhiko Kuroda. The yen performance against other currencies was not as impressive, though the Japanese currency still traded above the opening level. Kuroda said today that the yen is “very weak” and that it is hard to see the “real effective rate falling further.” As for discrepancy between … “Japanese Yen Soars After Kuroda’s Comments”

AUD/USD: Trading the Australian jobs Jun 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Jun 2015”

NZ Dollar Traders Near Opening Level

The New Zealand dollar had fallen initially during the Tuesday’s trading session but has bounced later and is trading close to the opening level as of now. This week should be rather important for the currency due to the upcoming central bank’s policy meeting. New Zealand’s manufacturing sales fell 2.8 percent in the first quarter of this year from the previous three months. While the report is not a particularly important one, … “NZ Dollar Traders Near Opening Level”

Australian Dollar Falls as China’s Data Disappoints

The Australian dollar fell today due to the negative macroeconomic data from China. Economic indicators from Australia itself were moderately positive but did not support the nation’s currency. China’s annual inflation slowed to 1.2 percent in May from 1.5 in the month before, falling short of market expectations of 1.3 percent. The Producer Price Index dropped 4.6 percent last month. Today’s reports followed yesterday’s data that … “Australian Dollar Falls as China’s Data Disappoints”