The Japanese yen logged gains today after the final revision of the nation’s economic growth has turned out to be better than analysts had expected. The yen gained against such currencies as the US dollar and the Great Britain pound. Japan’s gross domestic product grew 1 percent in the first quarter of this year from the previous three months compared to the preliminary estimate of 0.6 percent and the expected increase of 0.7 percent. Year-on-year, … “Yen Gains After Final Revision of Japan’s GDP”

Month: June 2015

Japanese GDP surges – will this stop the BOJ?

The final GDP report for Q1 showed that the Japanese economy economy grew by 1% q/q, much better than 0.6% originally reported. Year over year, a solid rate of 3.9% was printed, far better than 2.8% predicted. The strong growth rate is certainly encouraging for the Japanese economy but does not go hand in hand with the … “Japanese GDP surges – will this stop the BOJ?”

Why EUR rallied on Draghi, and what’s next – MM #53

cussing the forex industry’s hot story about Plus 500 and preview next week’s events. You are welcome to listen, subscribe and provide feedback. EUR after the ECB: Draghi tried to avoid any excitement. His security detail prevented another confetti incident but his words certainly shook markets. What did he say or didn’t say that triggered this? We discuss … “Why EUR rallied on Draghi, and what’s next – MM #53”

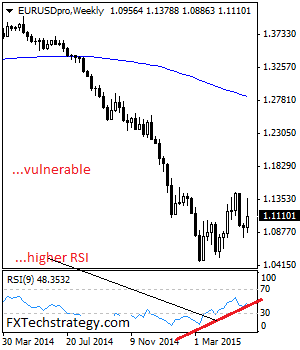

EURUSD: Vulnerable Despite Weekly Higher Close

EURUSD: Although EUR closed higher the past week, it faces downside pressure after losing a quarter of its last week gains (see daily chart). This development leaves it vulnerable to the downside. Resistance is seen at the 1.1150 level with a cut through here opening the door for more upside towards the 1.1200 level. Further … “EURUSD: Vulnerable Despite Weekly Higher Close”

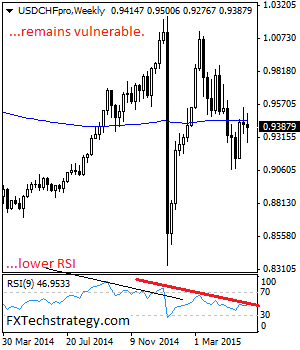

USDCHF: Risk Points Lower On Price Failure

USDCHF: The pair continues to look vulnerable after closing marginally lower the past week. If a follow through lower is seen in the new week, further weakness will follow On the downside, support comes in at the 0.9300 level. A turn below here will open the door for more weakness to occur towards the 0.9250 … “USDCHF: Risk Points Lower On Price Failure”

Euro Ends Week Being Strongest Among Major Rivals

The euro has been the strongest major currency during the past trading week. The currency weakened a bit by the weekend but kept gains against its most traded rivals nonetheless. There were several reasons for the euro’s rally. One of them was the data that had shown inflation in Germany as well as in the whole eurozone. Another was the surging German bond yields. The shared 19-nation currency trimmed its gains by the end of the week … “Euro Ends Week Being Strongest Among Major Rivals”

3 positive takes on the NFP and 3 reasons NOT

The US Non-Farm Payrolls report was a blockbuster, and not only in the headline. It’s been a while seen we’ve seen something so convincing. Here are 3 positive takes from the report, which certainly justify the dollar rally that followed. But is it enough for June? Probably not. Here are three reasons for the Fed to … “3 positive takes on the NFP and 3 reasons NOT”

Malaysian Ringgit Leads Drop of Asian Currencies

There have been plenty of reasons for the riskier Asian currencies to drop including concerns about the eurozone and Greece in particular, the rally of the US dollar and the decline of Asian bonds. The Malaysian ringgit has led the drop. The rally of the dollar and the problems with Greece has made the trading environment highly adverse to risky currencies of emerging markets. The news affected the currencies not just directly but also by hurting the Asian equity market, leading to the decline … “Malaysian Ringgit Leads Drop of Asian Currencies”

Sterling Drops vs. Dollar, Fares Better vs. Other Majors

As most other currencies, the Great Britain pound fell against the US dollar today after the release of non-farm payrolls. The sterling fared better against other majors, including the euro. The dollar was simply too strong to be beaten by the pound due to the positive US employment data. Yet macroeconomic indicators in Great Britain itself were not bad either, as the Bank of England/Gfk NOP Inflation Attitudes Survey showed that inflation … “Sterling Drops vs. Dollar, Fares Better vs. Other Majors”

Canadian Dollar Leaps as Employment Data Supports

The Canadian dollar made a huge leap higher today after the release of amazingly good employment data from Canada. The currency was able to outperform the US dollar, which itself had been bolstered by employment data from the United States. Canadian employment grew by 58,900 (seasonally adjusted) in May after the disappointing report for April that has shown a drop by 19,700. The May increase was far above the predicted rate of 10,200. … “Canadian Dollar Leaps as Employment Data Supports”