US Nonfarm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Update: Non-Farm Payrolls: +280K – USD surges Published on Friday … “EUR/USD Trading the US Non-Farm Payrolls”

Month: June 2015

ZAR About to Endure More Agony from USD

The Rand is Set to Experience A Crippling Blow in Coming Months! Interest Rate Hikes Dash Hopes of ZAR Recovery The ZAR is one of several emerging currencies set to experience ongoing declines in the coming months. As part of a vulnerable group of currencies, the South African rand is staring down a barrel against … “ZAR About to Endure More Agony from USD”

EUR/USD: Volatile Path Toward Parity By Year-End – BofA

EUR/USD rallied hard following the ECB “sitting on the fence” stance in the rate decision. Despite this volatility, the team at Bank of America Merrill Lynch sees the pair going down to parity. Here is their reasoning: Here is their view, courtesy of eFXnews: Bank of America Merrill Lynch continues to expect a gradual EUR/USD weakening towards … “EUR/USD: Volatile Path Toward Parity By Year-End – BofA”

FxPro expands CFD offering

FxPro, a UK regulated and Cyprus based forex broker, has announced a wider offering for clients: more CFDs. FxPro and FXStreet recently kicked off a new advertising model. For more on the new offering, here is the official press release: Here is more from the official press release: 01 June 2015, London. Award winning FX broker … “FxPro expands CFD offering”

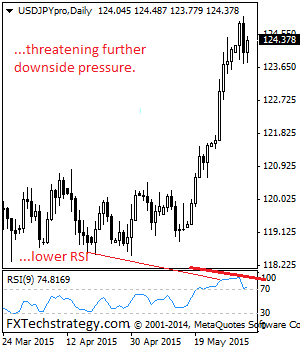

USDJPY: Faces Pullback Threats

USDJPY: The pair still remains weak and vulnerable on corrective pullback though seen hesitating during early trading on Wednesday. However, except it returns above the 125.04 level, risk continues to point lower. On the upside, resistance resides at the 125.00 level with a turn above here aiming at the 126.00 level. A break will target … “USDJPY: Faces Pullback Threats”

Loonie Drops Back After Yesterday’s Gains

Fueled by US dollar weakness and better oil prices, the loonie headed higher yesterday. Today, though, the Canadian dollar is down again, heading lower against the greenback and its other major counterparts. Yesterday, as the greenback’s weakness became the story on the back of falling North American stocks and disappointing economic data, the Canadian dollar got a bit of a boost. Most of those gains are being erased today as the greenback reasserts itself, and as oil … “Loonie Drops Back After Yesterday’s Gains”

US Dollar Regains Some Lost Ground

US dollar is regaining some of the ground it lost yesterday, but is still somewhat weak. Greenback is higher against its major counterparts, but still hasn’t reached the performance level seen before yesterday’s mauling. Yesterday, the greenback was down across the board, being savaged by the euro as optimism about a Greek deal, combined with the lackluster data out of the United States, pointed to a weaker dollar. Today, … “US Dollar Regains Some Lost Ground”

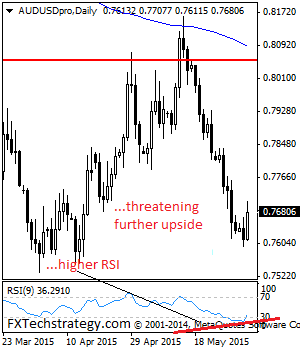

AUDUSD: Turns Higher On Strength

AUDUSD: With the pair halting its weakness and strengthening, more gain is envisaged. On the downside, support resides at the 0.7650 level where a breach will aim at the 0.7600 level. Below that level if seen will set the stage for a run at the 0.7550 level. A cut through here should target further downside … “AUDUSD: Turns Higher On Strength”

Get Ready For The Next Leg Lower In EUR/USD –

EUR/USD has certainly recovered on the back of optimism for Greece as well as USD weakness. This does not deter the team at Goldman Sachs, which sees the pair going well below parity: Here is their view, courtesy of eFXnews: In a special note to clients today, Goldman Sachs discusses the reasons behind the current … “Get Ready For The Next Leg Lower In EUR/USD –”

Indian Rupee Weaker After Central Bank Cuts Interest Rates

The Indian rupee was down a little against the US dollar following yesterday’s decision of India’s central bank to reduce interest rates in order to support economic growth. The Reserve Bank of India cut its interest rates yesterday, including the Bank Rate, which has been reduced by a quarter of percentage point to 8.25 percent. Bank’s Governor Raghuram Rajan said in the statement: With still weak investment and the need to reduce supply constraints … “Indian Rupee Weaker After Central Bank Cuts Interest Rates”