The Greek crisis has deteriorated rapidly and has already sent EUR/USD down in an impressive Sunday gap. But the euro is not the only currency at play. There are other impacts, and Citi advises: Here is their view, courtesy of eFXnews: Citi’s take on the initial moves outside of EUR is that they have been a bit … “Greece Fallout Continues; How To Play It Outside Of EUR?”

Month: June 2015

3 Things To Focus On As Greek Crisis Escalates –

Following the unfolding Greek crisis, which already sent EUR/USD far below, the team at Deutsche Bank weighs in. Here are three things to focus on: Here is their view, courtesy of eFXnews: There have been three major developments on the Greek crisis over the last forty-eight hours,notes Deutsche Bank. “First, the Eurogroup meeting yesterday confirmed … “3 Things To Focus On As Greek Crisis Escalates –”

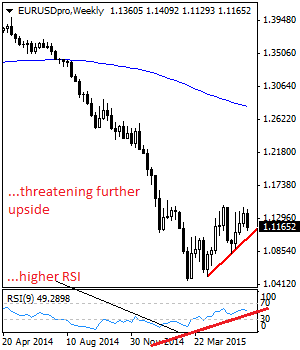

EURUSD: Risk Turns Lower

EURUSD: With EUR taking back its previous week gains to close lower last week, further weakness is envisaged. However, we may see a correction higher of the mentioned declines in the new week. Resistance is seen at the 1.1250 level with a cut through here opening the door for more upside towards the 1.1300 level. … “EURUSD: Risk Turns Lower”

Greek crisis – updates from 7 forex brokers

The crisis in Greece has significantly deteriorated over the weekend. This implies extreme volatility as markets open in early Asian trading. Some brokers have taken measures and others have warned. They would like to avoid another SNBomb turbulence. . Here are the first reactions from 7 brokers: Alpari: Warned that trading conditions may change in EUR/USD and EUR/JPY. … “Greek crisis – updates from 7 forex brokers”

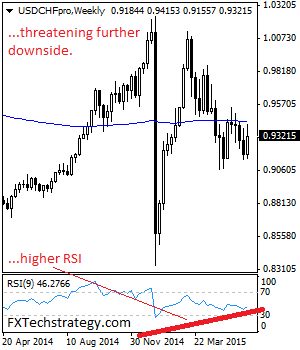

USDCHF: Reverses Losses, Eyes Further Upside With Warning

USDCHF: With Having reversed its previous week losses the risk of a move further higher is envisaged in the new week. Resistance resides at the 0.9428 level with a breach targeting the 0.9500 level. A breather may occur here and turn the pair lower but if taken out, expect a push higher towards the 0.9550 … “USDCHF: Reverses Losses, Eyes Further Upside With Warning”

Euro Ends Week with Losses, Next Week Promises Volatility

The past trading week was dominated by the debt problems of Greece and attempts to find a solution that would be acceptable both for the indebted country and for its creditors. Yet no agreement has been reached, and with the June 30 deadline looming close, traders preferred to get rid of the euro, leading to a weekly drop of the currency. Trading was relatively subdued during the week as market participants were unwilling to take excessive risk. The euro … “Euro Ends Week with Losses, Next Week Promises Volatility”

Euro Ends Friday Lower as Greece Rejects Proposal

The euro ended Friday lower as the short-term proposal to Greece from its international creditors was rejected, leaving just a few days to find a solution to the Greek debt woes before the troubled country runs out of money. The deal proposed to Greece included tax and pension reforms in exchange for a bailout package that would allow the nation to repay a part of its debt. Yet Greek officials were not satisfied with the proposal that … “Euro Ends Friday Lower as Greece Rejects Proposal”

Japanese Yen Weakens as Inflation Slows

The Japanese yen fell during the current trading session as today’s data showed that nation’s inflation slowed. This means that the Bank of Japan may boost monetary stimulus to achieve its target 2 percent inflation. Japan’s consumer prices (excluding food) rose 0.1 percent in May from a year ago after rising 0.3 percent in the previous month. Tokyo’s core inflation index showed the same 0.1 percent … “Japanese Yen Weakens as Inflation Slows”

NZ Dollar Goes Lower Even as Trade Surplus Widens

The New Zealand dollar dropped against its US counterpart and the Japanese yen today even though domestic fundamentals were supportive for the currency as the nation’s trade balance demonstrated an unexpected surplus. New Zealand’s trade excess widened to NZ$350 million in May from the revised NZ$183 million in the prior month. The actual value was far better than the pessimistic analysts’ forecast of a NZ$90 million deficit. Yet this did not help … “NZ Dollar Goes Lower Even as Trade Surplus Widens”

UK Pound Mostly Rangebound Today

UK pound is mostly rangebound today, thanks to a lack of new data. Additionally, a recent speech from David Cameron has many speculating about the United Kingdom’s relationship to the European Union. Sterling is rangebound today, although it is on the mostly lower side against its major counterparts. Right now, there isn’t a lot of data today, although recent weeks have indicated that the UK economy continues … “UK Pound Mostly Rangebound Today”