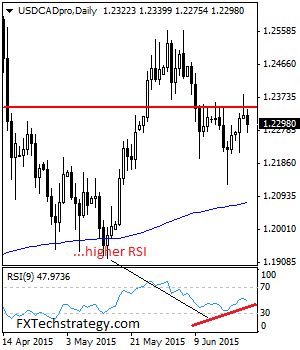

USDCAD: Having capped its recovery at the 1.2381 level to close on a reject candle on Tuesday, a move back to the downside could be building up. That move has already been triggered. On the upside, resistance is seen at the 1.2400 level followed by the 1.2450 level. Further out, resistance comes in at the … “USDCAD: Loses Upside Momentum, Declines”

Month: June 2015

Pound Gains on Dollar Ahead of US GDP Report

The Great Britain pound gained on the US dollar and was little changed against the euro today. Moves were limited as traders waited for data from the United States and the resolution of the Greek situation. A report about US gross domestic product will be released later today, and experts predict that it will show a decrease by 0.2 percent. This allowed the sterling to gain on the dollar with the added help of hopes for a positive outcome … “Pound Gains on Dollar Ahead of US GDP Report”

Yen Higher vs. Dollar, Falls vs. Euro

The Japanese yen rose against the US dollar but fell versus the euro today. The Bank of Japan released minutes of its May meeting during the current session. The minutes said: With regard to the outlook, Japan’s economy is expected to continue recovering moderately. The year-on-year rate of increase in the CPI is likely to be about 0 percent for the time being, due to the effects of the decline in energy prices. As for the monetary stimulus, they added: Quantitative … “Yen Higher vs. Dollar, Falls vs. Euro”

5 Most Predictable Currency Pairs – Q3 2015

A predictable currency pair loses slows down when it approaches a clear technical resistance or support level, eventually reversing back within the range. If this currency pair has strong momentum, it makes a distinct break, piercing through the line and more importantly: not looking back. Yet not all currency pairs are born equal: the less predictable … “5 Most Predictable Currency Pairs – Q3 2015”

Video: Greece, Euro Parity, & The Biggest Trades For H2

The first half of the year was certainly turbulent. Was does the second half entail? The team at Bank of America Merrill Lynch lay out their thoughts in the video below, which includes the option of EUR/USD parity: Here is their view, courtesy of eFXnews: In its mid-year press conference in New York today, Bank … “Video: Greece, Euro Parity, & The Biggest Trades For H2”

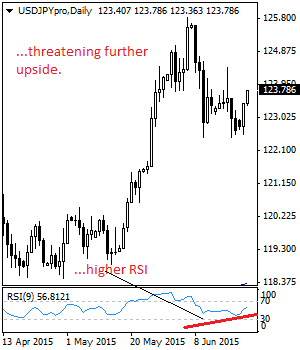

USDJPY: Bullish, Remains On The Offensive

USDJPY: With USDJPY maintaining its bullish offensive following its Monday strength, further upside pressure is likely in the days ahead. It looks to retarget the 124.24 level. On the upside, resistance resides at the 125.00 level with a turn above here aiming at the 125.50 level. A break will target the 126.00 level. Further out, … “USDJPY: Bullish, Remains On The Offensive”

NZ Dollar Drops to 5-Year Low vs. US Dollar

The New Zealand dollar dropped to the lowest level in almost five years against it US peer as traders were seeking safer currencies amid the Greek crisis. At the same time, the kiwi was little changed against the Japanese yen. Talks about the bailout for Greece stalled on Monday, ending without reaching a deal. There are hopes that can be achieved an agreement by the end of the week, but for now traders prefer to play … “NZ Dollar Drops to 5-Year Low vs. US Dollar”

Australian Dollar Avoids Impact of Negative Domestic Data

The Australian dollar held steady against its US counterpart and managed to gain on the Japanese yen today even though economic data from Australia was not particularly supportive to the currency. The Conference Board Leading Index for Australia slipped 0.3 percent in April after showing no change the month before. The House Price Index rose 1.9 percent in the March quarter — not a bad reading by itself, but lower than analysts’ … “Australian Dollar Avoids Impact of Negative Domestic Data”

EUR/USD: Trading the US GDP June 2015

US Final GDP is a key release and is published each quarter. GDP reports measure production and growth of the economy, and are considered by analysts as one the most important indicators of economic activity. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible outcomes for … “EUR/USD: Trading the US GDP June 2015”

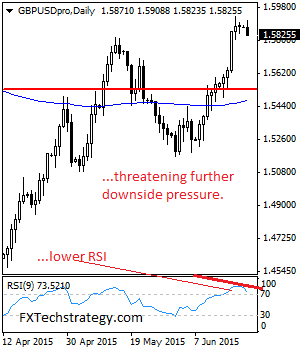

GBP/USD Triggers Correction On Price Failure

GBPUSD: With GBP triggering a correction during Monday trading session, we expect more weakness to occur in the days ahead. On the upside, resistance resides at the 1.5900 level with a break aiming at the 1.5950 level. A violation of here will aim at the 1.6000 level and possibly higher towards the 1.6050 level. Its … “GBP/USD Triggers Correction On Price Failure”