TradeProofer is a forex trader community where members can benchmark their broker’s quote and trade execution against other members’ brokers. TradeProofer release monthly reports on broker spreads to summarize how the community saw brokers’ spreads. This time we focus on May. The charts show spread distribution of each broker for a selection of 10 currency … “How’s your broker’s spread in May? Detailed data for”

Month: June 2015

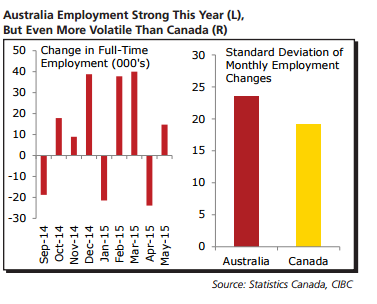

Not So Dotty On The USD; CAD To Top Higher

Commodity currencies often run in tandem with each other and sometimes in a different manner to the major currencies. What’s going on in AUD and CAD? The team at CIBC weighs in: Here is their view, courtesy of eFXnews: The following are CIBC’s weekly outlook for the USD, CAD, and AUD. Not So Dotty On the US$. … “Not So Dotty On The USD; CAD To Top Higher”

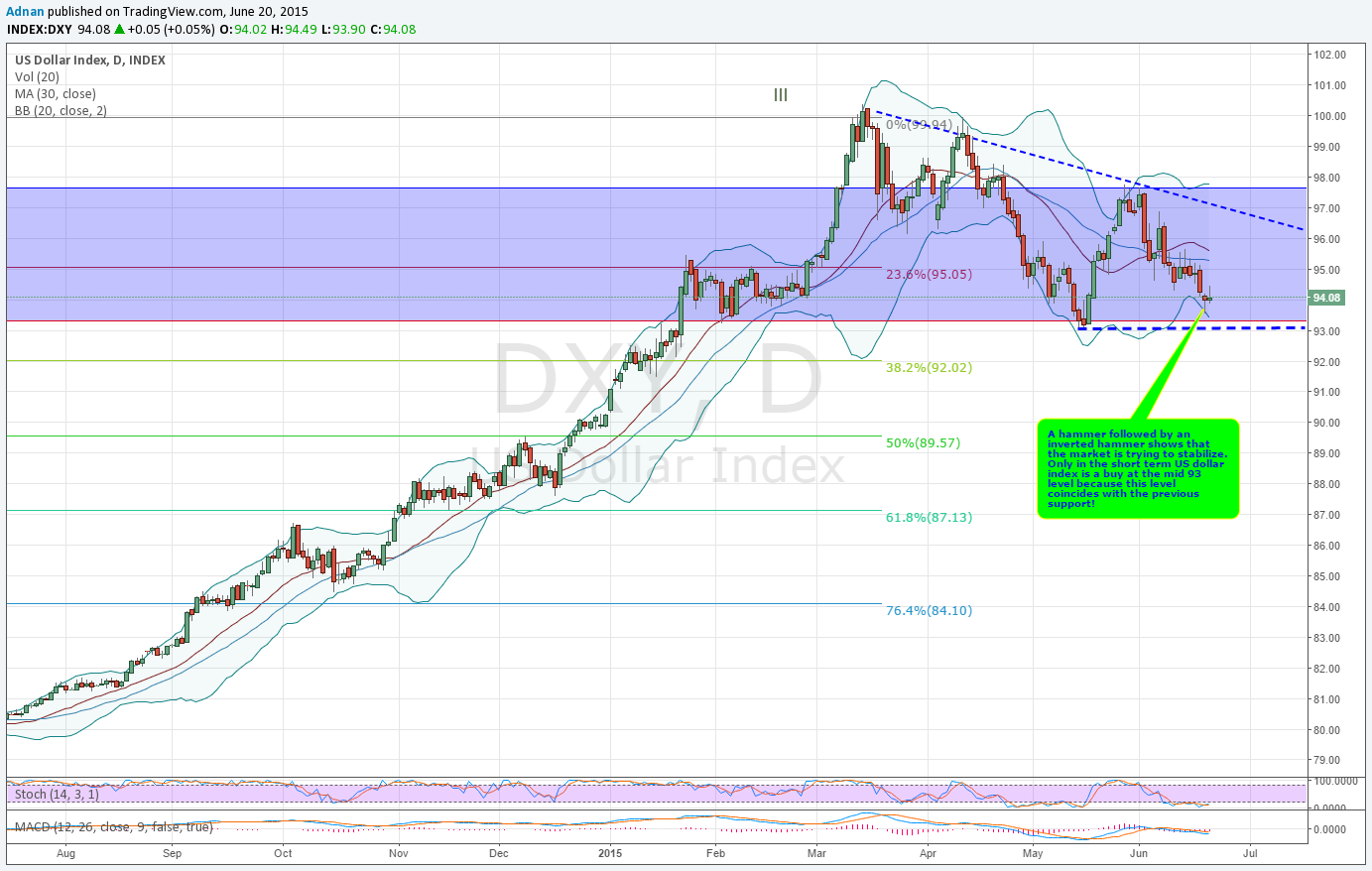

US$ Index: Gains only in the short term

The overall bias on the US$ index still is down albeit its effort to stabilize on the daily chart. The stabilization appears to be emerging with the hammer and inverted hammer formations near the support region of 93. Given the fact that there have been many bearish engulfing patterns continuously exerting a downward momentum on … “US$ Index: Gains only in the short term”

The correct mindset for making consistent profits

Many people believe that trading simply involves clicking some buttons and money churns out. This just couldn’t be further from the truth. People also often believe that driving is a simple task. In reality, if you ask any professional driver they’ll tell you just how complex it is. Any fool can sit behind a wheel … “The correct mindset for making consistent profits”

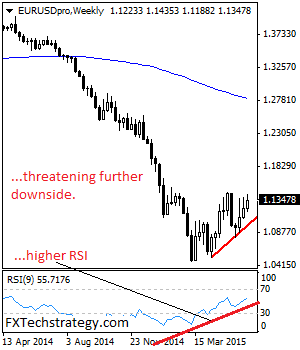

EUR/USD: Retains Upside Bias But With Caution

EURUSD: EUR may have closed higher the past week but with caution as pullback threats could occur. Resistance is seen at the 1.1450 level with a cut through here opening the door for more upside towards the 1.1500 level. Further up, resistance lies at the 1.1550 level where a break will expose the 1.1600 level. … “EUR/USD: Retains Upside Bias But With Caution”

Digesting the Dollar Dove Dive -MM #55

No surprise is also a surprise when it’s a Fed decision. We run down the FOMC meeting, update on the ever-escalating Greek crisis and discuss next week’s important events. You are welcome to listen, subscribe and provide feedback. FOMC rundown: This is what happens when the doves don’t cry: we break down the various elements of the Fed … “Digesting the Dollar Dove Dive -MM #55”

EUR/USD: Fade Rally On Any Greek Resolution – BNPP

Reports over the weekend suggest that there is some progress around the Greek crisis. Will we see a deal soon? If so, the team at BNP Paribas suggests fading any Greek related rally. Here is their rationale: Here is their view, courtesy of eFXnews: “Despite a dovish market reaction to this week’s FOMC statement, the … “EUR/USD: Fade Rally On Any Greek Resolution – BNPP”

AUD/USD: Trading the HSBC Chinese Flash PMI Jun 2015

HSBC Chinese Flash Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in China. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are all the details, and 5 … “AUD/USD: Trading the HSBC Chinese Flash PMI Jun 2015”

Dollar Dips During Week of FOMC Decision

The US dollar dipped during the past trading week, demonstrating especially big losses versus the Great Britain pound. Two themes dominated the Forex market over the week: one being bullish for the greenback, another was bearish. The bearish one was the policy meeting of the Federal Reserve. The statement of the meeting was rather dovish and suggested that the Fed is not in a hurry to raise interest rates. While a rate hike is possible … “Dollar Dips During Week of FOMC Decision”

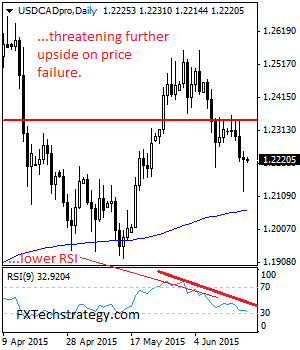

USDCAD: Risk Points To The Upside On Correction

USDCAD: With USDCAD closing on a rejection candle a move higher could be developing. On the upside, resistance is seen at the 1.2300 level followed by the 1.2350 level. Further out, resistance comes in at the 1.2400 level where a turn lower may occur. But if further recovery is triggered resistance comes in at the … “USDCAD: Risk Points To The Upside On Correction”