The Swiss franc gained on the US dollar and held steady versus the euro during the current trading session even though the Swiss National Bank decided to keep negative interest rates at today’s policy meeting. The SNB maintained the policy of charging 0.75 percent interest on deposits made to the bank. The central bank remained unhappy with the exchange rate, saying that “the Swiss franc is significantly overvalued.” Yet the SNB will be hard-pressed … “Swiss Franc Resilient Despite Negative Interest Rates”

Month: June 2015

NZ Dollar Dips as Economic Growth Disappoints

The New Zealand dollar dipped against its major counterparts today as the nation’s economic growth disappointed market participants, being far slower than they had counted on. New Zealand gross domestic product expanded 0.2 percent in the first quarter of 2015 versus the expectations of a 0.6 percent increase. Moreover, the previous quarter’s growth was revised slightly down from 0.8 percent to 0.7 percent. The kiwi sank after … “NZ Dollar Dips as Economic Growth Disappoints”

EUR/USD Risk-Reward: Market In 2-Minds – Credit Suisse

So, we had the Fed and the Greek crisis is still going on. EUR/USD did move up to the higher end of the range but still respects the double top. So what’s next for euro/dollar and all its moving parts? The team at Credit Suisse lays it out: Here is their view, courtesy of eFXnews: In … “EUR/USD Risk-Reward: Market In 2-Minds – Credit Suisse”

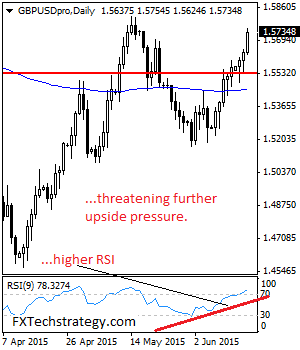

GBPUSD: Bullish, On The Tear

GBPUSD: With GBP strengthening strongly further on Wednesday, further bullishness is envisaged. This development leaves the pair targeting further upside towards the 1.5813 level where a break will aim at the 1.5850 level followed by the 1.5900 level. A break will target the 1.5950 level where a violation will aim at the 1.6000 level where … “GBPUSD: Bullish, On The Tear”

Dollar Down After Fed Releases Dovish Statement

The Federal Reserve released its monetary policy statement today and it was not positive for the dollar at all, being considered by the markets as a dovish one. The greenback extended its losses against the euro and the Great Britain pound while the US currency pared its earlier gains against the Japanese yen. The Fed left its monetary policy unchanged, in line with market expectations. The central bank also suggested that when the interest … “Dollar Down After Fed Releases Dovish Statement”

US Dollar Pulls Back as Traders Await Fed Announcement

US dollar is pulling back today, heading a little bit lower as Forex traders wait for the Federal Reserve’s announcement about what’s next for the greenback. Policymakers at the Federal Reserve are entering the second day of a two-day meeting to discuss interest rates and plans for monetary policy. An announcement is expected this afternoon, and the greenback is a little lower as Forex traders consolidate their positions and wait for what’s next. Some analysts and traders … “US Dollar Pulls Back as Traders Await Fed Announcement”

GBP/USD: Trading the British Retail Sales Jun 2015

British Retail Sales is considered one of the most important economic indicators. A reading that is higher than the market forecast is bullish for the British pound. Update: UK Retail Sales +0.2% – GBP/USD extends gains Here are all the details, and 5 possible outcomes for GBP/USD. Published on Thursday at 8:30 GMT. Indicator Background Retail Sales is the primary … “GBP/USD: Trading the British Retail Sales Jun 2015”

Sterling Leaps After Upbeat Data

The Great Britain pound leaped today after the fairly upbeat employment data from the United Kingdom. The sterling reached the strongest level since May 15 against the US dollar and the highest since September 2008 versus the Japanese yen. Average weekly earnings rose 2.7 percent in February through April compared to the same period a year ago, exceeding the analysts’ projection of 2.5 percent growth. Unemployment claims fell 6,500 in May … “Sterling Leaps After Upbeat Data”

Traders Seek Safety of Swiss Franc

The Swiss franc ticked up today after investors had found renewed interest in currencies considered to be safe. So happens, the Swissie is one of such currencies. The flight to safety was caused by concerns about potential default in Greece. The threat of default in the indebted Eastern European country forced investors to seek safer assets, making the franc an attractive investment. The Swiss National Bank will conduct policy meeting on Thursday and may … “Traders Seek Safety of Swiss Franc”

US Q1 GDP probably higher and the Fed knows it

As we await the all-important FOMC meeting, it’s a good opportunity to remind everybody that the Fed looks through the weakness in Q1 and cheers up on the encouraging data for Q2. But apart from growing evidence of the “transitory” nature of Q1, it’s important to note that perhaps the first quarter was not as bad as … “US Q1 GDP probably higher and the Fed knows it”