The Canadian dollar was extremely weak today, falling even against the soft US dollar. The Canadian currency was dragged down by the slump of crude oil prices and the unexpected decline of Canada’s economy. Canadian gross domestic product fell 0.2 percent in May, demonstrating the fifth consecutive monthly decline. Market participants had hoped ahead of the report that it would show a zero change. Crude oil prices sank more … “Canadian Dollar Dragged Down by Oil Prices & Falling GDP”

Month: July 2015

Dollar Loses Strength in Friday’s Trading

The US dollar started the last trading session of this week on a strong footing but was unable to retain its strength to the end of trading. The currency is now broadly lower against other majors, falling more than 1 percent against the euro. US economic data was weighing on the greenback, pushing it lower. Growth of the employment cost index slowed to 0.2 percent in the second quarter of this year from 0.7 … “Dollar Loses Strength in Friday’s Trading”

Australian Dollar Declines

The Australian dollar declined today even though domestic fundamentals were not particularly bad. The most likely reason for the currency’s poor performance is the outlook for monetary tightening from the Federal Reserve that drives most currencies down. The Aussie followed the kiwi in the decline even though the Australian economic data was not nearly as bad as the New Zealand one. While growth of the Producer Price Index and private sectors credit slowed … “Australian Dollar Declines”

New Zealand Dollar Goes Lower as Business Confidence Wanes

The New Zealand dollar dropped during the current trading session as today’s data showed that business confidence is waning in the South Pacific Nation. The ANZ Business Confidence sank as low as -15.3 in July from -2.3 in June. The report said that there is no need to be overly pessimistic: Such readings in themselves do not mean the economy is becalmed. Political vagaries, the weather, those winter blues, and the general … “New Zealand Dollar Goes Lower as Business Confidence Wanes”

Euro Drops as IMF Will Not Provide Aid for Greece

The euro was in rout today after a report that the International Monetary Fund will not participate in the third round of the bailout for Greece. Prospects for monetary tightening in the United States put additional pressure on the euro, as well as on other currencies. Financial Times reported today that Greece’s “high debt levels and poor record of implementing reforms disqualify Greece from a third IMF bailout of the country.” This means that some eurozone countries … “Euro Drops as IMF Will Not Provide Aid for Greece”

US Dollar Continues Move Upward

The US dollar extended its yesterday’s rally today, rising against most of its major peers, even though US economic growth was somewhat disappointing last quarter. The Great Britain pound attempted to resist the dollar’s strength but was unable to keep gains. According to the first (advance) estimate, US gross domestic product grew 2.3 percent in the second quarter of 2015, less than economists had predicted — … “US Dollar Continues Move Upward”

USD/CAD: Trading the Canadian GDP Jul 2015

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 … “USD/CAD: Trading the Canadian GDP Jul 2015”

Australian Dollar Attempts to Defy Adverse Fundamentals

The Australian dollar attempted to rally today, defying adverse fundamentals, but the rally has been limited so far. In fact, the currency retreated to the opening level against its US peer, though managed to keep gains versus the Japanese yen. Australian building approvals sank as much as 8.2 percent in June from May, about 10 times the analysts’ expectations. The poor data added to the downside pressure on the Aussie caused by yesterday’s policy … “Australian Dollar Attempts to Defy Adverse Fundamentals”

NZ Dollar Moves Down After Domestic Data & Fed Statement

The New Zealand dollar fell today, driven down both by domestic macroeconomic data and by the monetary policy statement of the Federal Reserve. The currency was moving down for the past two days, but the drop was not enough to erase the huge Tuesday’s rally. New Zealand building permits dropped 4.1 percent in June after showing no change in the preceding month. Yesterday, the Federal Reserve released a policy statement that left an open … “NZ Dollar Moves Down After Domestic Data & Fed Statement”

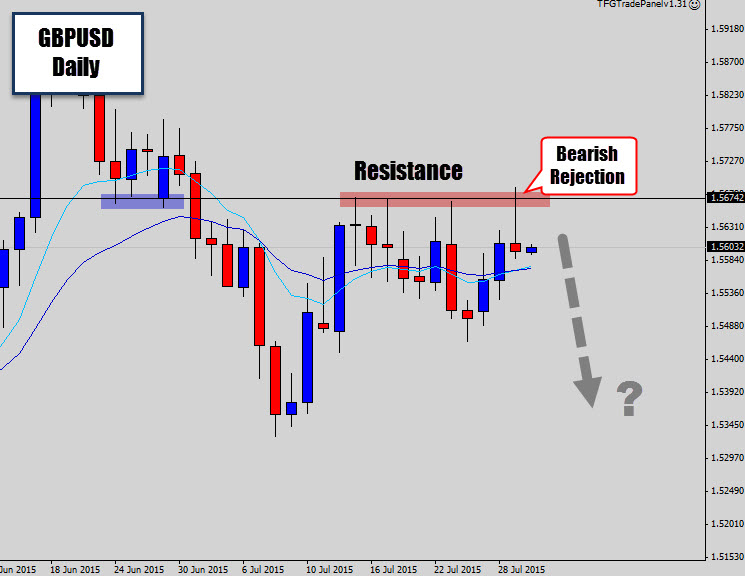

GBPUSD Rejects Daily Resistance Level – Bearish Reversal Candle

GBPUSD has been stuck in this holding pattern under a stubborn resistance level on the daily chary, which has been containing price for the past couple of weeks. Again, the market moved up into this resistance level and the higher prices were denied, and pushed back lower to create a bearish rejection candle in response … “GBPUSD Rejects Daily Resistance Level – Bearish Reversal Candle”