The markets will open to the results of the Greek referendum, aka #Greferendum. How will the euro react?

The team at BNP Paribas finds the best trade:

Here is their view, courtesy of eFXnews:

In its weekly note to clients today, BNP Paribas assess the FX response to this weekend’s Greek referendum, outlining the potential EUR response to a Yes/No vote along with the best EUR trade to position for such an event.

Good news for Greece is bad news for the EUR.

“We continue to believe that good news on Greece represents bad news for the EUR. The ECB’s quantitative easing programme (QE) is the key factor driving down the EUR, as the single currency is used as the key funding currency for FX carry trades. EURUSD is overvalued versus 2y rate spreads. Disappointing headlines on Greece produce a risk-off approach in markets that results in the unwinding of carry trades and buying back of the EUR. We believe this logic will remain in place around Sunday’s referendum,” BNPP argues.

EUR response to a Yes/No vote.

“A ‘yes’ outcome should produce a relief rally in markets and encourage investors to again add to EUR-funded carry trades. This will drive the EUR lower. In contrast, a ‘no’ outcome may produce new risk reduction and a further unwinding of EUR shorts,” BNPP projects.

EUR positioning into the referendum.

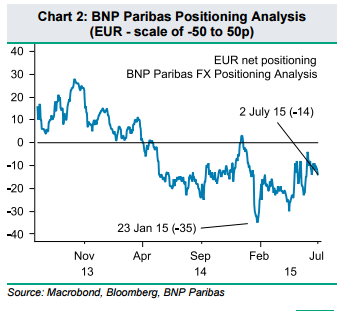

“Our BNP Paribas Indicator reports short EUR exposure at -14 (on our scale of -50 to 50), which is a moderate short but well below the trough of -35 in January. This logic on FX is supported by the relationship with peripheral spreads during the latest round of Greek negotiations since February. The FX interpretation is also consistent with our anticipated response by the eurozone peripheral bond market, including an overshoot in the immediate aftermath of the referendum,” BNPP notes.

How to play it? Sell EUR/JPY.

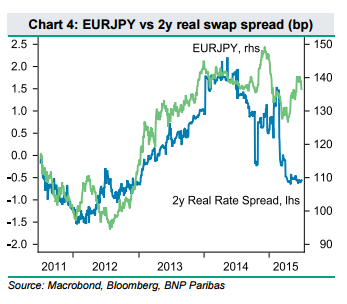

“A short EURJPY position also includes an element of a tail-risk hedge. Like EURUSD, EURJPY appears significantly overvalued according to 2y real rate spreads. A surprise ‘no’ vote would likely cause a sharp risk-off event similar to that of Monday morning (29 June). In this situation the EUR would drop sharply and the JPY would benefit as a safe haven, especially as the market is not currently running a net long JPY exposure,” BNPP advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.