We have heard about the wide Greek proposals, that open the way for a deal with creditors. However, nothing is 100% certain.

Here is how to trade the EU Summit, which has turned into a binary event, according to BNP Paribas:

Here is their view, courtesy of eFXnews:

In its last week’s FX note to clients, BNP Paribas recommends selling EUR/JPY as the best FX play to trade the outcome of the Greek Referendum. Today, BNPP is out with its game-plan to trade this weekend’s eurozone leaders’ summit which BNPP sees as the end-game for Greece.

The stakes are high for this weekend:

“The stakes are high for this weekend’s eurozone leaders’ summit. The message to Greece is clear: a deal must be reached or it leaves the eurozone. This situation is likely to produce a binary outcome for markets, including FX. We assess the best ways to trade this outcome over the weekend,” BNPP notes.

We have now come to the end of the road:

“We have seen many ‘deadlines’ during the Greek crisis, but this time we seem to have come to the end of the road and the creditors have, for the first time, presented Sunday as a firm deadline. The decision to invite all 28 countries to deal with the Greek crisis at the EU summit on Sunday is also unprecedented,” BNPP argues.

1. A Deal. Sell EUR relief rallies against USD, GBP:

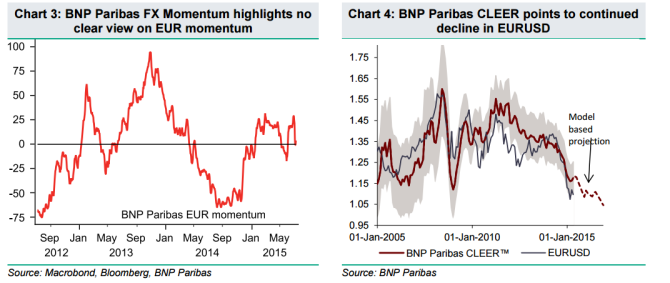

“This scenario produces a relief rally across most asset classes. European equities would rally and peripheral spreads would narrow. It is unlikely the EUR would appreciate broadly as it is difficult to argue that the single currency is trading at a discount to valuation. Outcome 1 would provide a catalyst for the re-establishment of EUR-funded carry trades,” BNPP advises.

“Accordingly, the EUR should depreciate, especially against higher yielders such as the USD and GBP. A clear exception would be EURCHF, which is likely to rally in this scenario. The CHF has served as a safe-haven – as indicated by the net long exposure of +24.,” BNPP projects.

2. No Deal. Sell EUR/JPY:

“This is the scenario the market fears…We view that EURJPY shorts would perform even better in this scenario, as an anticipated delay to Fed tightening would weaken the USD,” BNPP advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.