EUR/USD has been suffering the ramifications of the late Greek deal, but that’s certainly not the only factor moving the pair.

The team at Dankse stays short and explains in detail:

Here is their view, courtesy of eFXnews:

-EUR/USD should fall near term on Greece, Fed and FX hedging flows

-The disagreement between eurozone countries on Greece is a EUR negative

-In our FX Trading Portfolio we are short EUR/USD, target 1.02

Greece, Fed and flows.

Following the Greek deal 24 hours ago, EUR/USD has fallen like a stone. We see three reasons for this.

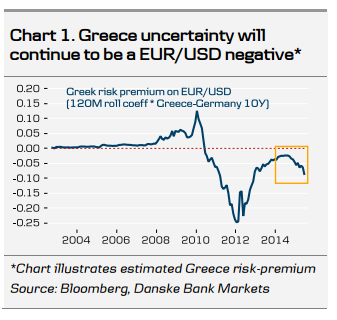

Firstly, the Greek contingent deal implies that the saga continues. Grexit risks are reduced for now but could return if the Greek authorities fail to implement the deal or future programme assessments are unsuccessful. Moreover, the negotiations over the weekend underlined a growing disagreement between eurozone countries – a clear EUR negative (See Grexit – what if? Greece kept on a short leash).

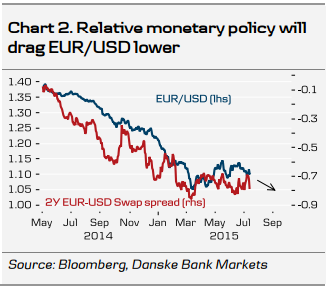

Secondly, the Greek deal opens the door for other central banks to act. We expect the Fed to begin its rate hiking cycle in September, which should widen US/eurozone short-term interest rates – a historical driver of EUR/USD.

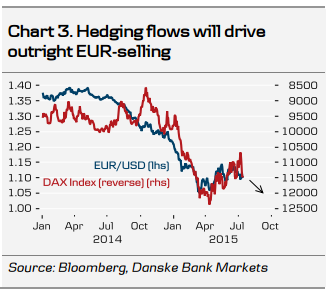

Thirdly, reduced Greek risk should support a rally in European equities. Rising European equities will drive EUR/USD selling from equity-focused currency overlay managers. As such, price action over the past 24 hours supports our view that EUR/USD should fall with or without a Greek deal.

FX outlook

We forecast EUR/USD at 1.04 in 3M, 1.06 in 6M and 1.10 in 12M. Relative interest rates and flows should support a fall in EUR/USD over the coming three months. In three to 12 months, rising eurozone inflation and discussions about an end to ECB QE should support a higher EUR/USD.

FX strategy

In our FX Trading Portfolio we are short EUR/USD, target 1.02, stop-loss 1.1550. Leverage funds should use bounces in EUR/USD ahead of 1.12 to add to short EUR risk.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.