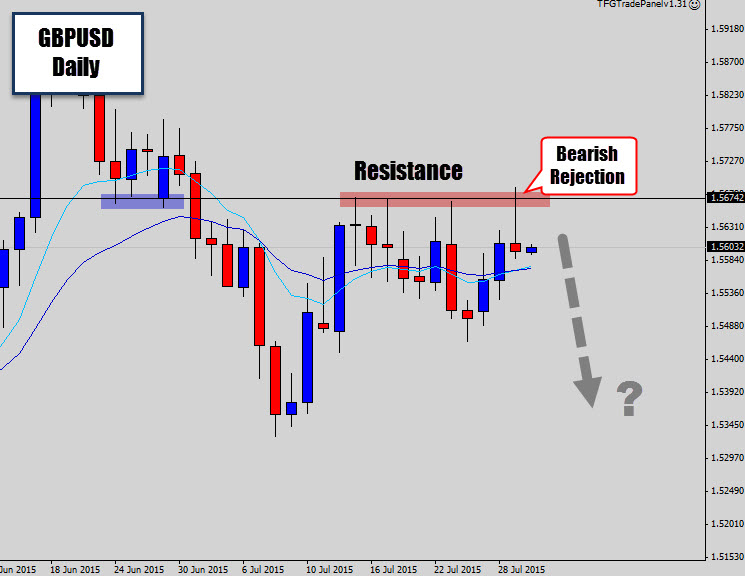

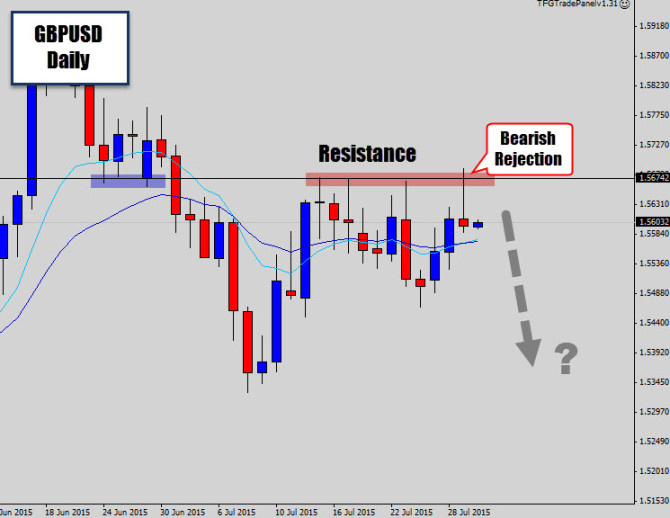

GBPUSD has been stuck in this holding pattern under a stubborn resistance level on the daily chary, which has been containing price for the past couple of weeks.

Again, the market moved up into this resistance level and the higher prices were denied, and pushed back lower to create a bearish rejection candle in response to the Fed’s FOMC release.

I am not sure what the Fed’s position was, but we can see the GBPUSD responded bearishly with the increase in USD strength. If the market breaks lower, we could see a breakout to the downside and a move into lower prices.