The US dollar bounced today following the yesterday’s drop even though economic data from the United States was not particularly supportive to the currency. US jobless claims climbed from 282,000 to 297,000 last week while analysts had promised a decrease to 274,000. The negative report did not deter the greenback from rising today, most likely due to the bid for safety from those investors who are worried about … “Dollar Bounces in Thursday’s Trading”

Month: July 2015

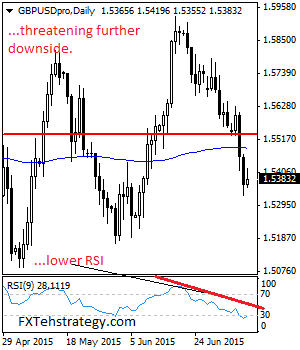

GBPUSD: Targets Further Downside

GBPUSD: Despite its present price hesitation, it faces downside pressure. On the downside, support lies at the 1.5400 level where a break if seen will aim at the 1.5350 level. A break of here will turn attention to the 1.5300 level. Further down, support lies at the 1.5250 level. Its daily RSI is bearish and … “GBPUSD: Targets Further Downside”

USD/CAD: Trading the Canadian Jobs Jul 2015

Canadian employment change is one of the most important Canadian indicators, which often has a significant impact on the markets. Traders and analysts carefully scrutinize employment figures, and a reading higher than forecast is bullish for the loonie. Update: Canadian employment falls only 6.4K, unemployment rate 6.8% – USD/CAD down Here are the details and 5 possible outcomes for USD/CAD. … “USD/CAD: Trading the Canadian Jobs Jul 2015”

Grexit Or Not, Sell EUR/USD targeting 1.02 – Danske

The Greek crisis seems to be heading to a showdown on Sunday’s EU Summit. But regardless of the results, the team at Danske see a sell opportunity: Here is their view, courtesy of eFXnews: The Greek ‘No’ sent EUR crosses lower but the initial move has already partly reversed. We see two main reasons for the limited … “Grexit Or Not, Sell EUR/USD targeting 1.02 – Danske”

Japanese Yen Leaps on Safe Haven Bid

The Japanese yen surged today, jumping more than 1 percent and reaching the highest level in seven weeks against the US dollar and the euro. The trading environment on the Forex market favors safer currencies, and so happens that the yen is one of such currencies. Concerns about developments in Europe and China are driving investors to seek safe haven assets in order to protect themselves against risk. The yen is traditionally a reasonable choice … “Japanese Yen Leaps on Safe Haven Bid”

Yuan Stable, Remains in Danger from Chinese Stock Market Crash

The Chinese yuan was relatively stable today, but market analysts are worried that the currency is vulnerable to the negative impact of the Chinese stock market collapse. More than a half of Chinese companies suspended trading of their shares on the Shanghai and Shenzhen exchanges. Yet all the efforts taken by traders and the Chinese government did not prevent the benchmark Shanghai Composite Index from plummeting 5.9 percent yesterday. As a result, the one-month implied … “Yuan Stable, Remains in Danger from Chinese Stock Market Crash”

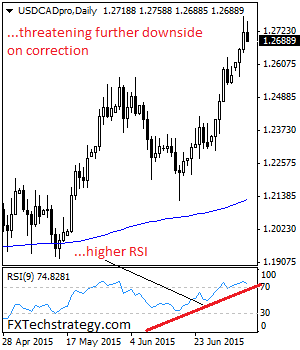

USDCAD: Sets Up To Weaken On Correction

USDCAD: With USDCAD strengthening further on Tuesday , it faces further upside risk. However, having lost a lot of those gains on Tuesday, we could see a correction lower in the days ahead. It was seen declining as at the time of this analysis. On the upside, resistance is seen at the 1.2800 level followed … “USDCAD: Sets Up To Weaken On Correction”

FXStreet and University of Essex Online launch 3rd edition

The third edition of the Financial Trading Course commences next month. The initiative by the University of Essex Online and FXStreet already experienced two successful intakes, and registration is open for the next course. Here are more details from the official press release: Barcelona, July 3rd, 2015 – FXStreet and University of Essex Online are … “FXStreet and University of Essex Online launch 3rd edition”

AUD/USD: Trading the Australian jobs Jul 2015

Australian Employment Change, which is released monthly, provides a snapshot of the health of the Australian labor market. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Job creation is one … “AUD/USD: Trading the Australian jobs Jul 2015”

Canadian Dollar Extends Monday’s Losses

The Canadian dollar extended its drop today, touching the lowest level since March against the US dollar and falling 1 percent versus the Japanese yen. At the same time, the loonie gained on the euro, though it trimmed most of initial gains. Domestic fundamentals were unfavorable to the Canadian currency as the nation’s trade balance deficit increased from C$3.0 billion in April to C$3.3 billion in May. It was a nasty surprise to those economists … “Canadian Dollar Extends Monday’s Losses”