Carney’s bullish comments sent the pound higher, but doubts remain. The team at Credit Agricole pours some cold water: Here is their view, courtesy of eFXnews: The latest GBP-rally reflects investors’ bets on growing policy divergence between the increasingly hawkish BoE and dovish central banks like the ECB, the SNB and the BoJ. What puzzles … “Why The GBP Rally Against The USD Is ‘Puzzling’ –”

Month: July 2015

Canadian Dollar Ends Week as Third Weakest Currency

The Canadian currency had a pretty rough week, falling against most of its major peers. And yet it was not the weakest currency during the past week as it was still able to gain on the euro and the New Zealand dollar. As was expected, the Canadian currency encountered hurdles during this week’s trading. While inflation was better than analysts’ prediction, the surprising interest rate cut from the Bank of Canada and the lackluster … “Canadian Dollar Ends Week as Third Weakest Currency”

Canada’s CPI Supportive for Loonie

The Canadian dollar fell a bit against the US dollar and the Japanese yen but rallied versus the euro during the Friday’s trading session. Macroeconomic data released from Canada today was largely positive for the currency. Canada’s Consumer Price Index rose 0.2 percent in June (not seasonally adjusted), matching forecasts exactly. What was even better, the core component of the index was unchanged versus the small drop by 0.1 percent … “Canada’s CPI Supportive for Loonie”

Dollar Heads to Biggest Weekly Rally Since May vs. Euro

The US dollar gained on the euro today but was flat versus the Great Britain pound and the Japanese yen. Still, the currency was at the highest level in more than a month against the basket of other major currencies and was heading to the biggest weekly gains against the euro since May. Today’s economic reports from the United States were mostly supportive for the dollar, particularly the housing data, which showed that both housing starts … “Dollar Heads to Biggest Weekly Rally Since May vs. Euro”

GBP/CHF: Strength in Numbers

In a previous publication, A Clockwork Trade, 27 May 2015 I had pointed out that the Swiss export economy was threatened by its reputation as a financial safe haven. In particular, capital inflows into Swiss assets caused the Swiss Franc to become, in the words of Swiss National Bank Chairperson Thomas Jordan, “significantly overvalued”. By … “GBP/CHF: Strength in Numbers”

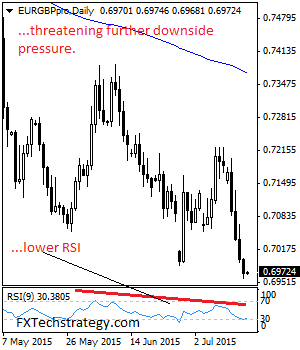

EURGBP- Declines Further

EURGBP- Having continued to weaken, the cross looks to extend that weakness. On the downside, support lies at the 0.6900 level where a break will expose the 0.6850 level. Further down, support comes in at the 0.6800 level where a violation will turn attention to the 0.6750 level. On the upside, resistance lies at the … “EURGBP- Declines Further”

Dollar Retains Strength After Mixed Data

Thursday’s macroeconomic reports from the United States were mixed, but this did not prevent the US dollar from rising. The currency reached the highest level since May 27 against the euro and the strongest since June 24 versus the Japanese yen. Supporting the US dollar, jobless claims fell last week and net foreign purchases increased in May instead of falling. On the negative side, the Philadelphia Fed manufacturing index dropped … “Dollar Retains Strength After Mixed Data”

Loonie Extends Move Down vs. USD, Performs Better vs. Other Rivals

The Canadian dollar continued to move down against its US counterpart following yesterday’s big slump. The currency held steady against the Japanese yen and even managed to gain on the euro. The Canadian currency was extremely weak after yesterday’s surprise interest rate cut from the Bank of Canada. Moreover, the central bank also revised its projections for Canada’s economic growth negatively. And on top of that, economists were pessimistic about inflation … “Loonie Extends Move Down vs. USD, Performs Better vs. Other Rivals”

EUR/USD – Trading the UoM Consumer Sentiment Index

The University of Michigan Consumer Sentiment Index surveys consumer attitudes and expectations about the US economy. An increase in consumer confidence is a positive sign about the health of the economy and is bullish for the US dollar. Here are all the details, and 5 possible outcomes for EUR/USD. Published on Friday at 14:00 GMT. Indicator … “EUR/USD – Trading the UoM Consumer Sentiment Index”

Aussie Regains Some Lost Ground After Earlier Plunge

Aussie is regaining some of the ground lost earlier after the announcement that the US Federal Reserve plans to raise rates before the end of the year. Commodity currencies were under pressure toward the end of the day yesterday, and the Australian dollar felt some of that. Aussie dropped to a six-year low overnight against the greenback, thanks to the latest information that the Fed really is getting ready to boost interest rates. Not only did … “Aussie Regains Some Lost Ground After Earlier Plunge”