The Great Britain pound was very soft against its major rivals on Monday. The currency demonstrated unimpressive performance even though the head of the nation’s central bank confirmed during the weekend that policy makers still plan to tighten monetary policy down the road. Mark Carney, Bank of England Governor, was speaking in Jackson Hole on Sunday. He said that the troubles of China’s economy will not change the central bank’s … “Pound Soft Even as Carney Talks About Tightening”

Month: August 2015

Canadian Dollar Follows Bounce of Oil Prices

The Canadian dollar, as it often happens, followed moves of crude oil prices during Monday. This resulted in losses initially but a bounce closer to the end of the trading session. Prices for crude oil have been falling during the first half of the Monday’s session, dragging the loonie down along with them. Yet crude soared more than 8 percent later, rescuing the currency. The Canadian dollar strongly linked to the performance of oil … “Canadian Dollar Follows Bounce of Oil Prices”

AUD/USD: Trading the Australian GDP Aug 2015

Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity, and a reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP Aug 2015”

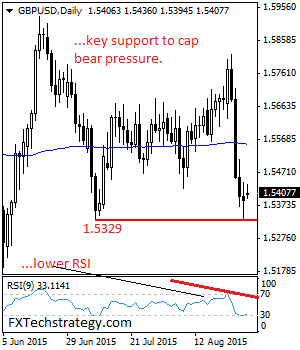

GBPUSD: Key Support To Cap Downside Pressure

GBPUSD: GBP sold off strongly the past week leaving risk of more declines. However, we think while its key support at the 1.5329 level holds as support a move higher on recovery should occur. On the downside, support lies at the 1.5300 level where a break if seen will aim at the 1.5250 level. A … “GBPUSD: Key Support To Cap Downside Pressure”

USD/CAD Bearish Rejection Candle Forming off Resistance – Looking

The USDCAD daily chart has started off this week with some pretty decisive price action. We’ve watched the CAD bears drive the USDCAD up the chart for a few months now, but all good things eventually come to an end – this uptrend can’t last forever. Is it time this market corrected? Price has stalled … “USD/CAD Bearish Rejection Candle Forming off Resistance – Looking”

US Dollar Loses Ground as Carry Trades Dominate

With traders looking for safe haven in an unsettled global market, the US dollar is heading lower. Greenback is struggling as Forex traders turn to the yen and to the euro. Worries about China remain strong today, and global stocks are falling as a result. US stocks have opened lower, with the Dow dropping more than 100 points almost immediately. Around the world, especially in Asia, stocks have been falling. Slowdown … “US Dollar Loses Ground as Carry Trades Dominate”

Euro Gains Ground as Traders Treat it Like a Safe Haven

Euro is gaining ground today, thanks to the fact that many Forex traders are treating the 19-nation currency like a safe haven. Euro is trading a lot like the Japanese yen right now, and that is leading to gains as concerns about the global economy, particularly in light of today’s performance in Asian markets, weigh on high beta currencies. Euro correlation with the yen is getting tighter. Indeed, the correlation is … “Euro Gains Ground as Traders Treat it Like a Safe Haven”

NZ Dollar Suffers from Domestic Data & Negative Market Sentiment

The New Zealand dollar dropped today due to some poor macroeconomic data as well as the general risk-negative market sentiment that hurt commodities linked to growth. The ANZ Business Confidence index slid from -15.3 in July to -29.1 in August. The report named several reasons for the pessimistic outlook of New Zealand businessmen, including the drop of commodity prices and the faltering economic growth of China. The data was detrimental for the New Zealand currency as was the risk-averse … “NZ Dollar Suffers from Domestic Data & Negative Market Sentiment”

Yen Feels Stronger After Jackson Hole Symposium

The Japanese yen gained today against some of its most-traded peers, including the US dollar and the Great Britain pound, thanks to the surge of risk aversion on the Forex market following the conclusion of the Jackson Hole symposium. Investors were not pleased to hear that central bankers of developed nations have troubles boosting inflation to the levels they want. The pessimistic tone of the meeting resulted in yet another drop of global stocks. The yen usually thrives … “Yen Feels Stronger After Jackson Hole Symposium”

This is what’s going on with EUR and China – MM #65

It is unusual to see such strong action in August and lots more is coming. We look at the major phenomenons: the situation in China and the euro’s erratic behavior before previewing the big events ahead. You are welcome to listen, subscribe and provide feedback. Chinese economic conditions: China giveth and China taketh away. The turmoil originated from the … “This is what’s going on with EUR and China – MM #65”