Since the 15 January Swiss National Bank surprise decoupling the Euro has since stabilized, albeit at lower levels, against the Swiss Franc. On that market shaking day, EUR/CHF plunged to 0.97127 from 1.2009. A six month chart eliminates the 15 January data, yet starts with a EUR/CHF low of 0.97756. EUR/CHF recovered to a six month high of 1.08123 in just over five weeks. It was still a ‘far cry’ from the 1.20 level, but now EUR/CHF more of a market driven conversion. The pair adjusted from the six month high through the 23.6% retracement level and eventually settled in the 1.0317 support, 1.0565 resistance range.

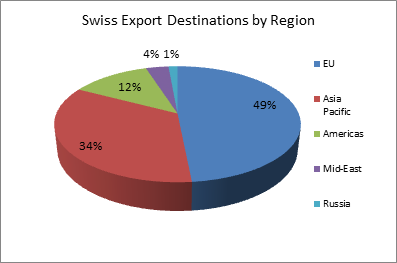

The dynamics are fivefold: The EU economy, the Greek-ECB impasse, the Swiss export economy, the Swiss as safe-haven currency, and the Asia-Pacific economies. The ‘interconnectivity’ of non EU member Switzerland with the larger Eurozone may be seen at a glance in the pie chart below.

Guest post by Mike Scrive of Accendo Markets

Just under half of all Swiss exports are destined for the EU. So a stronger Swiss Franc combined with recession level demand from the Eurozone would imply a slowing of the Swiss economy. When the ECB initiated its bond purchasing program, the Euro weaken from 1.0699 CHF on 9 March to 1.0249 CHF by 21 April; a 4.21% decline.

At the Swiss National Bank policy meeting of 19 March, the SNB decided to not only hold its benchmark deposit rate at -0.75 but also emphasized the need to weaken the overvalued Swiss Franc:”…We have now to see what is the impact and for the time being this is the right level… …In the very short term, we have to accept that inflation is now below zero, negative, but that will change...”

The safe haven currency continued to steadily gain against the Euro, as did most major currencies. At this point the ECB-Greek impasse seemed to be becoming a more serious issue as Alexis Tsipras and Angela Merkel convened in Berlin to negotiate for continued funding for Greece. On a positive note, the EU economy seemed to be showing signs of recovery as the Purchasing Manager’s Index improved for the second consecutive month.

At this time, China’s economy continued to slow in spite of many and varied PBOC efforts to reverse the trend. It is important to observe that when the Asia-Pacific region is taken as a whole, it is second only to the EU as an export market for Switzerland, importing 34% of all Swiss exported goods. So the SNB was being increasingly cornered by an unsettling situation in the Eurozone, capital inflows in spite of negative deposit rates and now further indications that China’s growth which affects the entire Asia Pacific region was continuing to contract.

The Euro continued to weaken against major currencies and the Franc strengthened driving consumer prices significantly lower. The 22 April release of Q1 GDP indicated that Switzerland was slipping into recession, contracting 0.1% with economist expectations for a further 0.2% decline in Q2.

By mid-May, the narrative remained the same; little progress had been made on any of the basket of economic issues. The Greek government and the ECB remained at an impasse; the Swiss National Bank kept its deposit rate well below zero causing the economy to slowly come to a halt, the Eurozone economy had some gains but had no real traction on overall recovery and the PBOC seemed powerless to halt the slowing Chinese economy. Also, to complicate matters further, it was about this time that the Greeks first floated the idea of a national referendum. By the end of May, Swiss GDP continued to contract as demand for exports declined.

So after six weeks with virtually no change in any situation, EUR/CHF broke resistance at 1.0427, after the ECB decided to maintain policy rate of 0.05% and continue with its €60 billion per month asset purchase program. Most encouraging was an uptick in CPI indicating a possible reversal of what was beginning to seem like chronic deflation in the Eurozone. The impasse with Greece worsened as the Greek banking system and government was literally running out of cash. In China, stock prices soared in spite of the continuing economic slowdown which had now spread to the wider Asia-Pacific economic region.

The concerns over the Chinese economy and Greek impasse only seemed to worsen by mid-June. The ECB could do nothing until after the referendum vote; Greece’s bailout support would end in less than two weeks. In the east, the PBOC was confronted with a suddenly deflating Shanghai and Shenzhen stock market.

SNB Chair Jordan now seemed to have an impossible task in his efforts to weaken the Franc and revive the export based economy. With interest rates so low, a Franc appreciating rapidly against the Euro, fund managers could create a positive carry. In fact, surveys indicated that fund managers preferred the Swiss France over the Japanese Yen. The strength of the Franc even overwhelmed that of the USD; the Euro, having recently gained on the Yen, lost ground to the Franc.

The point of the matter is that worsening economic issues in both the EU and Asia drove capital into the Swiss safe haven, greatly strengthening the currency, making Swiss exports more expensive when, at the same time the combined EU and Asia markets accounting for over 80% of Swiss exports was weakening.

To sum up, it seems that there’s a high likelihood that China’s problems are more structural than cyclical. The Greek impasse has reached its climax for the time being, the onus now being on the willingness of the ECB and EU member states to restructure Greek debt; (possibly including a write-down). The paradoxical situation has not gone unnoticed by Swiss economists, for example, economic minister Johann Schneider-Ammann recently commenting that, and “…The pressure on the franc is perhaps going to intensify…”

Lastly, should any of these crises intensify; the SNB may have no choice but to reduce the deposit rate further. On the other hand, if the status quo remains in place, the SNB must hold its ground until the existing external problems are resolved. In other words the Swiss Franc seems trapped in place.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”