The Canadian dollar managed to sift through an OK employment report and the pound survived the BOE blow.

What’s next for both currencies? The team at CIBC explains:

Here is their view, courtesy of eFXnews:

The following are CIBC’s weekly outlook for the CAD, and GBP.

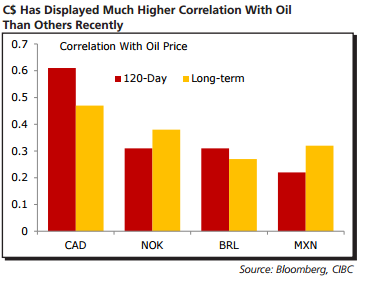

Oil Predominantly Drills Into C$. As oil prices have taken a further fall, they’ve dragged the C$ along for the ride. No real surprise there, after all the two are historically very highly correlated. What is somewhat of a surprise is how much higher the correlation has been recently when compared to other oilsensitive currencies such as the NOK, BRL and MXN. That partly reflects the fact that current levels of oil prices have had a greater impact on Canadian growth and monetary policy.

However, so long as oil prices don’t fall further, or even see a modest rebound, and Poloz stays on the sidelines, it could also be a sign that the C$ will regain a bit of ground against such currencies.

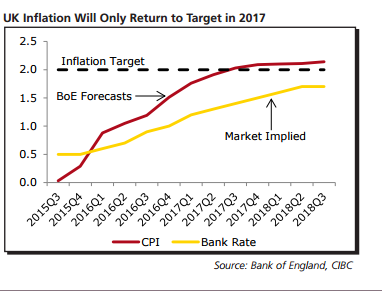

A Dovish Curveball for Sterling Traders. Despite some hawkish remarks from Governor Carney and other MPC members recently, yesterday’s deluge of BoE releases suggested that the central bank isn’t ready to raise interest rates just yet. Given that inflation was downgraded and is now only expected to return to target in 2017, the Inflation Report appeared to justify fixedincome traders’ dovish views. That stands in contrast to the strength seen recently in sterling, which was seemingly pricing in an earlier rate hike.

We still expect the Fed to move before the BoE and, as such, see the USD gaining some ground around the time of the first US rate hike in September. However, after that, look for sterling to respond to the more consistent rate hike path by the BoE and strengthen against the greenback in 2016.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.