EUR/USD is holding its high ground despite doubts about a Greek deal, strong US retail sales and not so impressive German growth.

What’s behind the resilience? The team at Morgan Stanley explains:

Here is their view, courtesy of eFXnews:

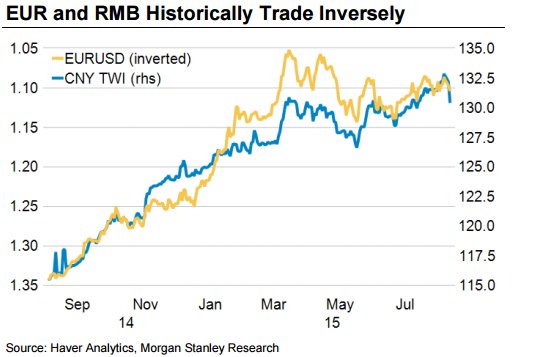

The direction of global risk appetite remains crucial for the relative performance of currencies within the core DM bloc, says Morgan Stanley.

“Continued risk appetite weakness should see EUR coming out the strongest, outperforming USD and to a lesser degree JPY, SEK and CHF,” MS argues.

“The reason for this temporary EUR strength is straightforward. EMU’s current account surplus keeps on rising, as corroborated by this week’s French trade surplus reaching €1 billion. Meanwhile, the high foreign hedge ratio on European assets implies that European equity weakness will lead to over-hedged positions and EUR buying,” MS clarifies.

“Should risk appetite remain fragile due to the China-induced VAR event, EMU will not see sufficient long-term capital outflows nor the use of EUR funding necessary to weaken the currency, in our view,” MS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.