The Canadian dollar has weathered the recent weakness in oil prices, but can it last_

The team at Morgan Stanley suggests buying Dollar/CAD this week:

Here is their view, courtesy of eFXnews:

Morgan Stanley picks USD/CAD as its technical FX chart of the week, where MS is bullish and long tactically and structurally MS provides the key levels where traders should consider buying the pair and placing their stops and targets accordingly.

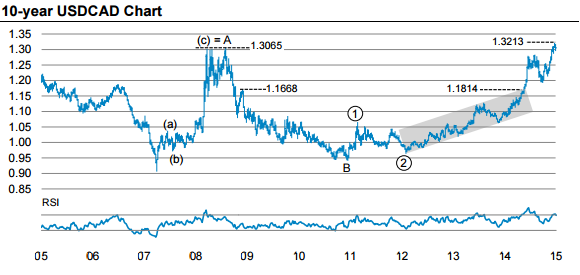

On the 10-year USD/CAD chart:

“The longer-term picture for USDCAD is bullish, and we recommend buying on any dips.Currently in a C-wave, the structure has exceeded the previous A-wave top at 1.3065. The current C-wave is incomplete since we believe it is still in a 3 rd wave. Our longer-term bullish analysis would be incorrect on a dip toward the low at 1.19,” MS advises.

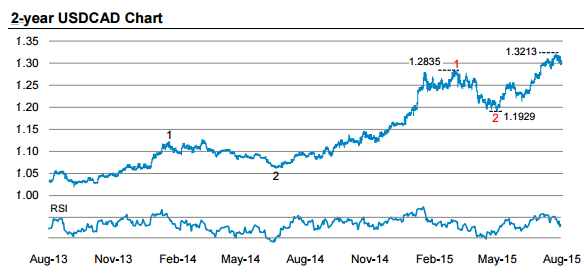

On the 2-year USD/CAD chart:

“USDCAD has large upside momentum as it is within a 3 rd wave of a larger 3rd wave. We target 1.40 in our strategic recommendations. A move below the 1 st wave high at 1.2835 would suggest that the near-term momentum may have faded, so we would have to wait for a larger dip to buy,” MS adds.

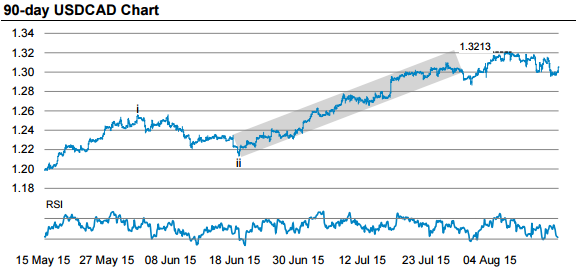

On the 90-day USD/CAD chart:

“We believe that USDCAD is in a sub-iiird wave that is incomplete. The dip toward 1.30 has provided a buying opportunity. Positioning in CAD is relatively light with our own tracker currently at -2. A move back above the 1.32 high should provide further upside momentum, in our view. We buy USDCAD and target 1.40,” MS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.