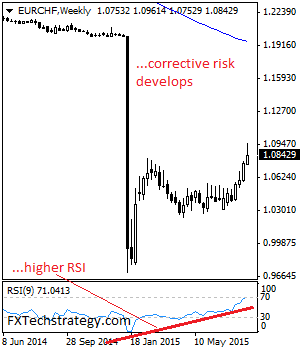

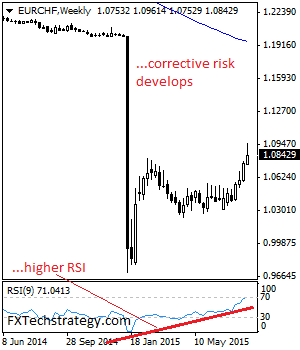

EURCHF: The cross may be biased to the upside in the medium term but its price failure taking back more than half of its gains the past week could trigger a full blown correction. Corrective signs are already seen on the daily chart.

Support lies at the 1.0800 level where a break will aim at the 1.0750 level and then the 1.0700 level. A break below here will turn attention to the 1.0650 level. Conversely, resistance resides at the 1.0900 level where a break will aim at the 1.0950 level.

A break of here will have to occur to create scope for a run at the 1.1000 level. Further out, resistance comes in at the 1.1050 level. All in all, EURCHF remains biased to the upside in the medium term but caution.

In our latest podcast we discuss predictable currencies vs. unpredictable central banks.

Follow us on Stitcher.