The US dollar has been struggling in the current risk off environment and this is also seen in the yields.

How should we position? Here are some answers from BNP Paribas:

Here is their view, courtesy of eFXnews:

The USD continues to struggle against the G10 funders amid diminished expectations for a September rate hike (our economists now see only a 10%-20% probability), notes BNP Paribas.

“We are likely to get decent US data next week, in particular revised Q2 GDP estimate which our economists are tracking at 3.4% q/q, but we don’t think this will be sufficient to alter expectations decisively and continue to stick with the December meeting for fed funds lift-off,” BNPP adds.

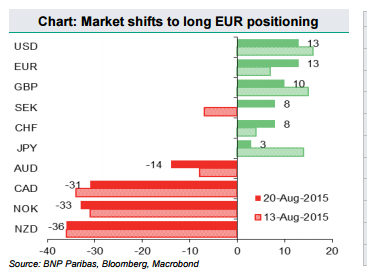

“In the absence of US front-end yield support we would thus caution against re-initiating USD longs against the EUR and JPY even though our positioning indicator suggests market has already unwound short positions on both currencies,” BNPP warns.

“The story is different for the commodity bloc – in the absence of help from Fed tightening local central banks are now more likely to ease in order to inject some stimulus via a weaker currency,” BNPP adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.