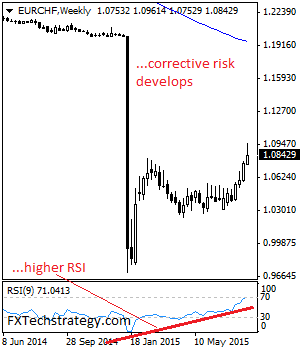

EURCHF: The cross may be biased to the upside in the medium term but its price failure taking back more than half of its gains the past week could trigger a full blown correction. Corrective signs are already seen on the daily chart. Support lies at the 1.0800 level where a break will aim at … “EURCHF: Hesitates, Corrective Threat Develops”

Month: August 2015

Morgan Stanley Chart Of The Week: Buying USD/CAD

The Canadian dollar has weathered the recent weakness in oil prices, but can it last_ The team at Morgan Stanley suggests buying Dollar/CAD this week: Here is their view, courtesy of eFXnews: Morgan Stanley picks USD/CAD as its technical FX chart of the week, where MS is bullish and long tactically and structurally MS provides the key … “Morgan Stanley Chart Of The Week: Buying USD/CAD”

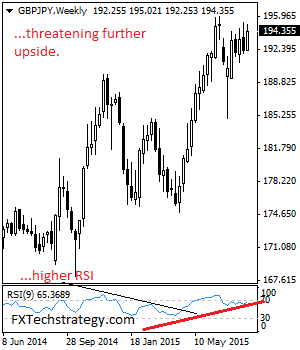

GBPJPY: Bullish, Price Momentum Builds Up On 195.83 Level

GBPJPY: Having GBPJPY closed higher the past week, risk of further bullishness remains on the cards. This if seen will allow the cross to target the 195.83 level, representing its year-to-date high. Further out, resistance lies at the 197.00 level followed by the 198.00 level where a break will aim at the 199.00 level. A … “GBPJPY: Bullish, Price Momentum Builds Up On 195.83 Level”

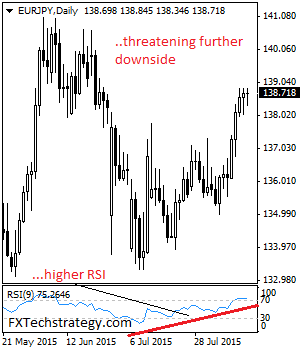

EUR/JPY: Remains On The Offensive With Eyes On 140.00

EURJPY: The cross remains biased to the upside with eyes on its key resistance at the 140.00 level. This is coming on the back of recent bullish offensive following its corrective recovery triggered off the 133.29 level. Resistance lies at the 139.50 level followed by the 139.50 level where a break if seen will threaten … “EUR/JPY: Remains On The Offensive With Eyes On 140.00”

GBPUSD Looks Higher, GBPJPY Trades Into A Triangle –

GBPUSD did not go far recently, but remains bullish as the recent decline was made in three waves. Ideally the market will rally today out of a downward channel and towards 1.5700. GBPUSD 1h Elliott Wave Analysis We are also tracking a bullish pattern for GBP on GBPJPY which is stuck in a triangle. Ideally … “GBPUSD Looks Higher, GBPJPY Trades Into A Triangle –”

What’s Behind This EUR Resilience? – Morgan Stanley

EUR/USD is holding its high ground despite doubts about a Greek deal, strong US retail sales and not so impressive German growth. What’s behind the resilience? The team at Morgan Stanley explains: Here is their view, courtesy of eFXnews: The direction of global risk appetite remains crucial for the relative performance of currencies within the core DM … “What’s Behind This EUR Resilience? – Morgan Stanley”

Higher Home Prices Help UK Pound Against Euro

Higher home prices are helping the UK pound against the euro today. Even though the pound is down against the dollar and the yen, it is finding success against the euro. Sterling is heading higher against the euro today, thanks in part to higher home price expectations. The Royal Institution of Chartered Surveyors reported that its UK home price gauge rose to 44 in July. This is a one-year high, … “Higher Home Prices Help UK Pound Against Euro”

US Dollar Index Recovers After Recent Selloff

The recent news of yuan devaluation took its toll on the greenback, but now the US dollar is coming back, thanks in part to helpful economic data. Yuan devaluation helped prompt a selloff in the US dollar, but now the greenback is making a comeback. The latest retail sales data for July indicate solid consumer demand and spending. Hopes that the US economy will keep moving forward — and that the Federal Reserve won’t … “US Dollar Index Recovers After Recent Selloff”

Markets may be re-warming to a Fed hike after data,

Yesterday, the US dollar suffered badly. The story was that China was doing the Fed’s tightening work and that a rate hike might wait and wait. 24 hours make a big difference: the greenback is making a comeback on some Chinese calm and good data from the US consumer. China A third day of yuan devaluation awaited … “Markets may be re-warming to a Fed hike after data,”

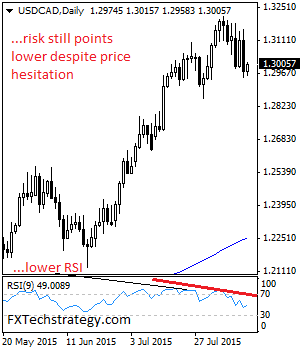

USDCAD: Trades Below Key Resistance, Retains Corrective Pullback Bias

USDCAD: With the pair reversing its Tuesday gains to close lower on Wednesday, risk of a follow through lower is envisaged. Despite its present price hesitation downside threat remains while the pair holds below the 1.3100/49 zone. Resistance resides at the 1.3050 level followed by the 1.3100 level. Further out, the 1.3150 level comes in … “USDCAD: Trades Below Key Resistance, Retains Corrective Pullback Bias”