The Chinese authorities made their move and devalued the yuan by nearly 2%. This move, accompanied by some liberalization of currency markets, hurt the Aussie, but it certainly has wider implications. The team at Credit Agricole explains: Here is their view, courtesy of eFXnews: In a surprise move overnight, the PBOC devalued the CNY by most … “After The CNY Tumble, JPY Should Be Next – Credit”

Month: August 2015

EUR/NZD: Got Milk?

Like most of its neighbors in the Asia-Pacific region, New Zealand has an export economy. However, as the chart demonstrates, New Zealand’s balance of trade seems to swing between trade surpluses and deficits over the past several years. Guest post by Mike Scrive of Accendo Markets The five largest of New Zealand’s export partners account for … “EUR/NZD: Got Milk?”

GBP/USD: Trading the British Aug 2015

British Average Earnings Index, released each month, is a leading of consumer inflation. A reading which is higher than the market forecast is bullish for the pound. Update: UK wages: +2.4% – GBP falls Here are all the details, and 5 possible outcomes for GBP/USD. Published on Tuesday at 8:30 GMT. Indicator Background The Average Earnings Index is closely … “GBP/USD: Trading the British Aug 2015”

USDSGD Bearish Rejection Candles – Mean Reversion Likely

The USDSGD has been in a monster bullish trend this year, but we’ve started to see some signs of temporary slow down. Going into last week’s close, we see two bearish rejection candles, with those upper tails displaying denials of higher prices right around a weekly resistance level. To usher us into this week’s trading, … “USDSGD Bearish Rejection Candles – Mean Reversion Likely”

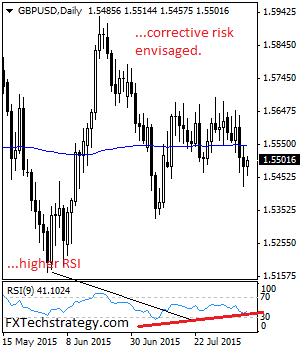

GBPUSD: Sets To Recover Higher On Rejection Candle Formation

GBPUSD: GBP looks to recover higher following its rejection candle print on Friday. This development leaves the immediate risk higher with its lower level charts (see 4 hourly chart) turning higher. On the downside, support lies at the 1.5450 level where a break if seen will aim at the 1.5400 level. A break of here … “GBPUSD: Sets To Recover Higher On Rejection Candle Formation”

Canadian Dollar Mostly Steady Today

Oil prices are inching higher today, but they are still below $45 a barrel. Canadian dollar is mostly steady against its major counterparts. While the loonie is mostly lower, it isn’t making any big moves today. Canadian dollar is holding steady today. Loonie is mostly lower against its major counterparts, although it is gaining against the euro, which … “Canadian Dollar Mostly Steady Today”

BOJ Expectations Point to Weak Yen

Expectations for more stimulus from the Bank of Japan are leading to more yen weakness today. With energy prices continuing to show weakness, BOJ policymakers are expected to keep attempting to stimulate the economy, and that means a lower yen. The Bank of Japan is once again weighing its options in the attempt to boost the Japanese economy. BOJ Governor Haruhiko Kuroda says that more stimulus could be coming, if oil … “BOJ Expectations Point to Weak Yen”

Oil Predominantly Drills Into CAD; A Dovish Curveball for

The Canadian dollar managed to sift through an OK employment report and the pound survived the BOE blow. What’s next for both currencies? The team at CIBC explains: Here is their view, courtesy of eFXnews: The following are CIBC’s weekly outlook for the CAD, and GBP. Oil Predominantly Drills Into C$. As oil prices have … “Oil Predominantly Drills Into CAD; A Dovish Curveball for”

The Biggest Forex Charts Mistakes

Making the right decision and planning an effective strategy in Forex is definitely one of the hardest things to do. Not all people are capable to do this, which is the reason why we have so many failures and disappointments connected with this business. On the other hand, some traders have learned how to improve … “The Biggest Forex Charts Mistakes”

Will they or won’t they? The Fed and also falling

Where is the Fed headed? A lot depends on the NFP. We discuss everything and also talk about falling oil and the somewhat neglected price of silver before previewing next weeks’s events. You are welcome to listen, subscribe and provide feedback. Direction of the Fed: Will they or won’t they in September? We hold opposing opinions and argue … “Will they or won’t they? The Fed and also falling”