The second half of 2015 began with the same trend seen beforehand: no new records, but a significant year over year gain. The Greek crisis played a significant role. As summer deepens, we can expect a somewhat slower August before a strong September. Here are the numbers for July 2015: Website: Page Views: 688,844. Visits: 287,557. Visitors: … “Forex Crunch Key Metrics – July 2015”

Month: August 2015

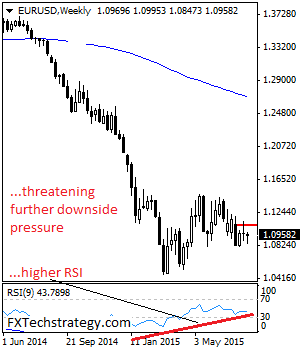

EURUSD: Risk Builds Up On With Eyes On 1.1128 Zone

EURUSD: Having EUR taken back most of its previous week losses to close flat the past week, we could see more recovery occurring in the new week. This development leaves risk higher in the new week though with caution. Support lies at the 1.0900 level where a violation will aim at the 1.0850 level. A … “EURUSD: Risk Builds Up On With Eyes On 1.1128 Zone”

USD Soars & Emerging Market Currencies Crumble

The inverse relationship that exists between the strength of the USD and emerging market currencies is a worrying phenomenon in today’s global economy. A September Rate Hike by the Fed will Turn the Screws on Weaker Currencies! Dollar Strength is Expected to Increase before the Year is Out Many an article has been written about … “USD Soars & Emerging Market Currencies Crumble”

What’s Next For GBP After Super-Thursday? – ANZ and

The big bulk of BOE related events hit the pound hard. But as this was a big bulk of data, markets continue digesting it and the reaction is far from over. Here are views from two banks on what awaits the pound. Here is their view, courtesy of eFXnews: First, ANZ: The BoE’s Super-Thursday was dovish … “What’s Next For GBP After Super-Thursday? – ANZ and”

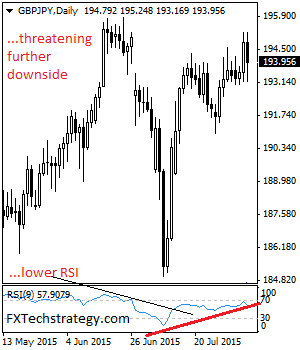

GBPJPY: Turns Lower On Price Failure

GBPJPY: The cross turned lower on Thursday taking back most of its Wednesday gains. This development leaves the cross targeting further downside pressure. On the downside, support comes in at the 193.00 level where a violation will aim at the 192.00 level. A break below here will target the 191.00 level followed by the 190.00 … “GBPJPY: Turns Lower On Price Failure”

Get Ready For Another EUR/USD Sell-Off Coming Weeks –

While EUR/USD is trading in somewhat lower ground, it hasn’t gone too far. Nevertheless, Credit Agricole sees another sell-off of euro/dollar in the next few weeks. Here’s why + targets: Here is their view, courtesy of eFXnews: The EUR has been broadly range-bound over the past few weeks, mainly due to relatively stable policy differentials. … “Get Ready For Another EUR/USD Sell-Off Coming Weeks –”

EUR/USD: Trading the US NFP Aug 2016

US Non-Farm Employment Change measures the change in the number of newly employed people in the US, excluding workers in the farming industry. A reading which is higher than the market forecast is bullish for the dollar. Here are the details and 5 possible outcomes for EUR/USD. Published on Friday at 12:30 GMT. Indicator Background Job … “EUR/USD: Trading the US NFP Aug 2016”

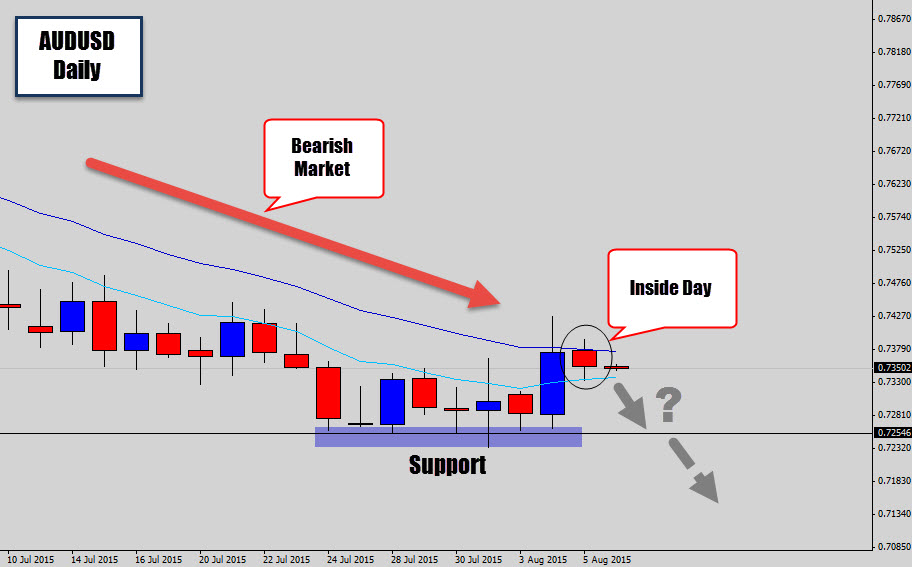

AUDUSD Inside Day – Waiting for Bearish Breakouts

The AUDUSD has been one of the big movers this year – a large long term bearish trend is powering down the charts as this market continues to weaken. During the last few weeks, the downward momentum has taken pause as the market slows down and consolidates a little above a support level. Last session, … “AUDUSD Inside Day – Waiting for Bearish Breakouts”

Greek crisis set for a comeback – debt restructuring

The Greek crisis faded into the back burner but is certainly not forgotten and it is set to reach the agenda quite soon: Greece has to pay the ECB on August 20th, and it doesn’t have the money. The big elephant in the room remains debt restructuring: after the IMF clearly supported it, more voices from the … “Greek crisis set for a comeback – debt restructuring”

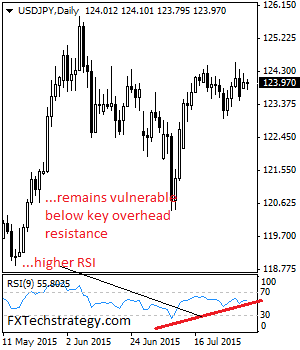

USDJPY – Vulnerable Below The 124.47/57 Zone

USDJPY – With the pair continuing to maintain below its key resistance at 124.57 level, a move lower should occur. Support resides at the 123.50 level with a turn below here aiming at the 123.00 level. A break will target the 122.50 level. Further out, support comes in at the 122.00 level where a violation … “USDJPY – Vulnerable Below The 124.47/57 Zone”