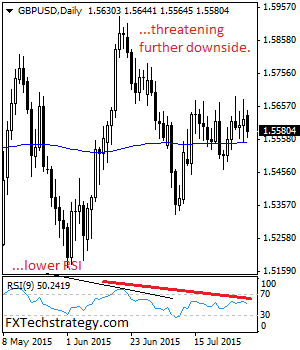

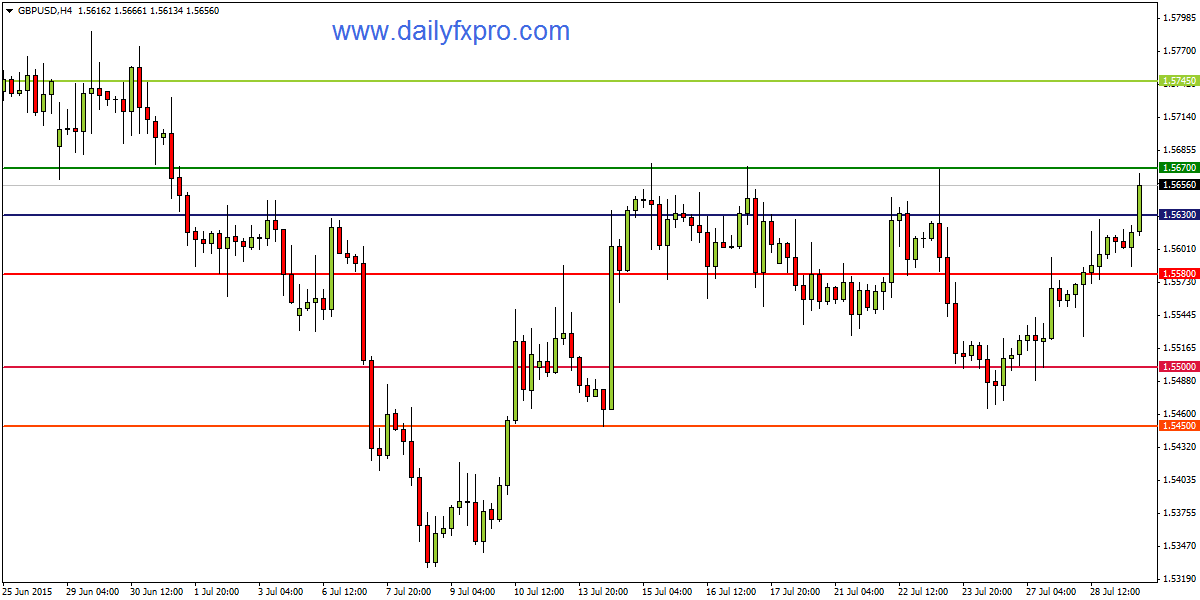

GBPUSD: GBP continues to look vulnerable to the downside on correction with more decline envisaged. On the downside, support lies at the 1.5550 level where a break if seen will aim at the 1.5500 level. A break of here will turn attention to the 1.5450 level. Further down, support lies at the 1.5400 level. Its … “GBPUSD: Risk Points Lower On Correction”

Month: August 2015

Why We Remain Strong USD Bulls in 3 Charts –

What’s in store for the US dollar on the road ahead after the recent Fed decision? The team at Deutsche Bank remain bullish, and they explain it with three charts: Here is their view, courtesy of eFXnews: “The trade-weighted dollar is making new cycle highs by the day. Here are some charts with fresh context to … “Why We Remain Strong USD Bulls in 3 Charts –”

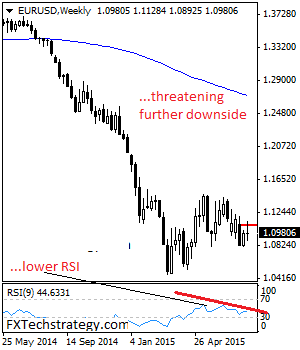

EURUSD: Loses Upside Momentum, Faces Downside Risk

EURUSD: Having EUR reversed its entire past week gains to close flat, it now faces risk of a move lower in the new week. Support lies at the 1.0900 level where a violation will aim at the 1.0850 level. A break of here will aim at the 1.0600 level with a turn below that level … “EURUSD: Loses Upside Momentum, Faces Downside Risk”

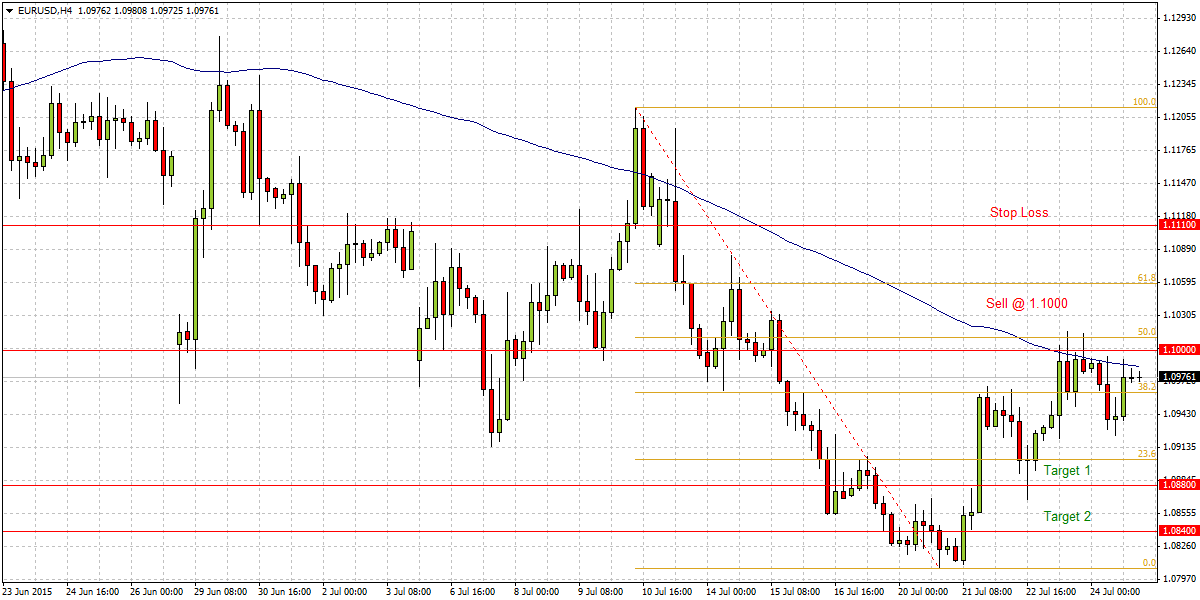

Will EUR/USD move above 1.1000 or stay below that level

The pair closed below 100-SMA on 4 hr chart. There is a very strong resistance around 1.1000 and at the same time it is also seen as a strong psychological resistance. The short term downtrend from 1.1210 to 1.0800 the retracement of 50% Fibonacci is also seen around 1.1010 and will also add additional resistance … “Will EUR/USD move above 1.1000 or stay below that level”

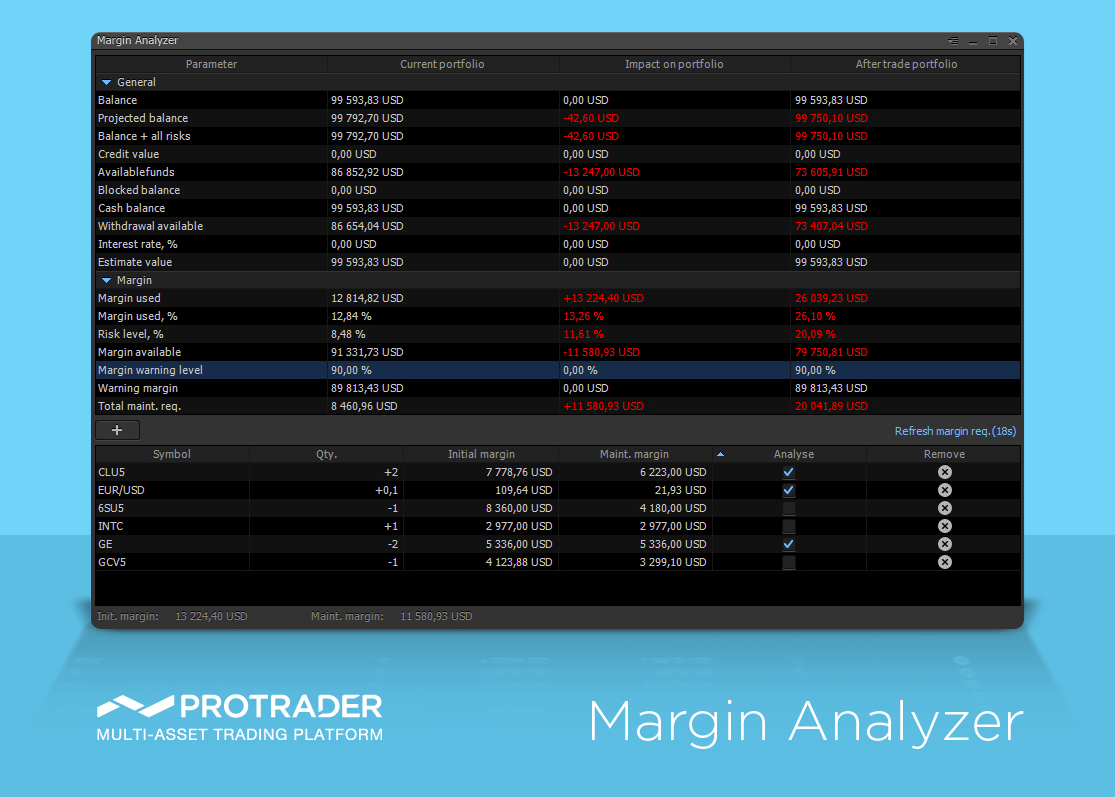

Protrader’s new Margin Analyzer Panel enhances risk management functionality

Risk management has become more sophisticated in the new Margin Analyzer tool within Protrader. Here is the official press release from PFSOFT: PFSOFT has announced a new advanced tool for professional traders and asset managers in the Protrader trading platform called Margin Analyzer. This panel allows customers to manage the level of risk and create more efficient … “Protrader’s new Margin Analyzer Panel enhances risk management functionality”

EUR/USD: Corrective/Messy; USD/CAD: Next Target – Goldman Sachs

What’s next for EUR/USD? The answer is apparently not so easy. Yet for the struggling Canadian dollar, the next target seems clearer. Here are the latest forecasts from Goldman Sachs: Here is their view, courtesy of eFXnews: Corrective markets tend to be messy and difficult which is very much the case for EUR/USD,notes Goldman Sachs Techs. “The … “EUR/USD: Corrective/Messy; USD/CAD: Next Target – Goldman Sachs”

The Chinese Finger Trap

Since the 15 January Swiss National Bank surprise decoupling the Euro has since stabilized, albeit at lower levels, against the Swiss Franc. On that market shaking day, EUR/CHF plunged to 0.97127 from 1.2009. A six month chart eliminates the 15 January data, yet starts with a EUR/CHF low of 0.97756. EUR/CHF recovered to a six … “The Chinese Finger Trap”

Important levels and technicals of GBPUSD

GBPUSD has cleared major resistance 1.5630 after the release of better than expected Lending and Mortgage Approvals data of UK. The pair has broken major resistance i.e 1.5630 the break above this level would extend gains till 1.5670 the next resistance and the second resistance 1.5745 in the short term. Until there is a break … “Important levels and technicals of GBPUSD”

Dollar Flat After Week of Mixed Fundamentals

The US dollar was mostly flat against its major-traded peers with the notable exception of the Great Britain pound that demonstrated a substantial rally against the greenback, erasing the previous week’s losses. There were two important events for the US currency during the week, and one turned to be supportive while the other one was not so much. The positive event was the monetary policy meeting of the Federal Reserve. While the Fed … “Dollar Flat After Week of Mixed Fundamentals”