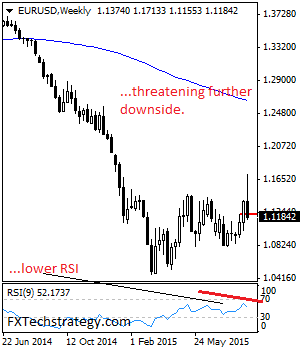

EURUSD: EUR lost its upside momentum to close lower the past week leaving further downside pressure on the cards in the new week. However, note that a consolidation with a pullback higher may occur. Support lies at the 1.1100 level where a violation will aim at the 1.1050 level. A break of here will aim … “EURUSD: Bias Remains To The Downside”

Month: August 2015

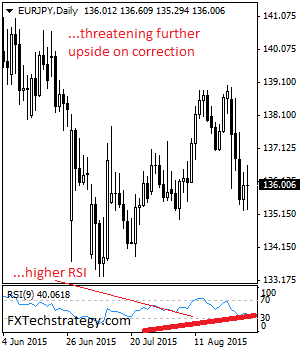

EURJPY: Halts Weakness, Eyes More Recovery

EURJPY: The pair recovered on Thursday and followed through on Friday though marginally to put in a temporary bottom. This development could suggest a move further higher on more recovery as we enter a new week. In such a case, support comes in at the 135.50 level where a break will aim at the 135.00 … “EURJPY: Halts Weakness, Eyes More Recovery”

Dollar Weathers Impact of China’s Stock Collapse

The week has started with a surge of risk aversion on the Forex market as the collapse of China’s stock market scared investors. Surprisingly enough, the dollar dropped against its major rivals after the event. Yet the currency reversed its losses very quickly, rising for the most part of the week. China’s stocks plunged yet again on Monday, driving investors to safer assets. The dollar did not profit from this as the euro overtook the role … “Dollar Weathers Impact of China’s Stock Collapse”

Is the Federal Reserve being bullied by the Markets?

With Black Monday’s upset in the markets being the focus point of financial news this week, Market reporter – Michael Hunter – joined Nick Batsford and Zak Mir in the Tip TV studio to discuss the implications this has had on an interest rate hike in the US. Nobody wants to be the Grinch who … “Is the Federal Reserve being bullied by the Markets?”

Dollar Bounces as Fischer Doesn’t Discard Possibility of September Hike

The US dollar was rather soft for the most part of Friday’s session but bounced by the close with support of comments from Federal Reserve Vice Chairman Stanley Fischer. Fischer was talking to CNBC today, and he said that “there was a pretty strong case” for a September interest rate hike. He then added that the central bank should not wait too long before starting monetary tightening. Other … “Dollar Bounces as Fischer Doesn’t Discard Possibility of September Hike”

Crude Oil Prices Rescue Canadian Dollar

The Canadian dollar was falling for the most part of Friday’s trading session but reversed its movement as of 14:00 GMT and currently almost erased its losses. The reason for such behavior was the sudden surge of oil prices. Crude oil were also performing poorly during the current session, dragging oil-related currencies down. Yet prices resumed its rally recently, rescuing the Canadian dollar from the decline. It is hard … “Crude Oil Prices Rescue Canadian Dollar”

Eurozone Economic Confidence Rises and Sparks Hope for Euro

Economic confidence in the eurozone rose unexpectedly in August. This surprise development in the 19-nation currency region has sparked a little hope for the euro, and sent it higher against some of its major counterparts. Euro is still struggling against macroeconomic issues right now, but the latest confidence in the eurozone should help a little. According to the European Commission, an index measuring economic confidence in the eurozone rose from 104 to 104.2 for August. A prediction … “Eurozone Economic Confidence Rises and Sparks Hope for Euro”

Ruble Pulls Back After Massive Gains

The Russian ruble fell on Friday, dragged down by falling crude oil prices. Today’s drop followed yesterday’s massive gains that were also caused by moves of prices for crude. The price for Brent crude oil fell 0.44 percent to $47.35 today in New York. This hurt the ruble, and demand for foreign currency by local companies also contributed to the decline. Yesterday, the Russian currency surged 4 percent as oil prices demonstrated the biggest … “Ruble Pulls Back After Massive Gains”

Pound Extends Decline for Third Session

The Great Britain pound extended its drop for the third straight day against the US dollar during the Friday’s trading session. The currency found little support from domestic macroeconomic data even though indicators were rather good. UK gross domestic product expanded 0.7 percent in the second quarter of this year according to the second estimate — unchanged from the first estimate and in line with expectations. The GfK UK Consumer … “Pound Extends Decline for Third Session”

AUD/USD to 0.68 by December – ANZ

The Chinese crisis was already hitting the Aussie when data from home such as capital expenditure hit it. What’s next? The team at ANZ has clear targets: Here is their view, courtesy of eFXnews: Over the past twelve months we have seen an evolution in the drivers of the weakness in the AUD from outright … “AUD/USD to 0.68 by December – ANZ”