Australian Private Capital Expenditure, released each quarter, is an important leading indicator which can have a significant impact on the markets. A reading which is higher than the market forecast is bullish for the Australian dollar. Here are the details and 5 possible outcomes for AUD/USD. Published on Thursday at 1:30 GMT. Indicator Background Private Capital Expenditure … “AUD/USD: Trading the Australian Capex Aug 2015”

Month: August 2015

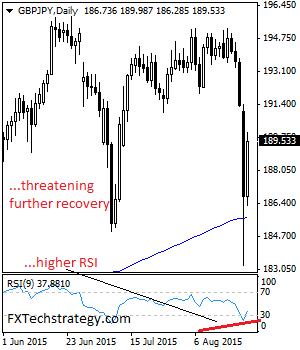

GBPJPY Recovers, Turns Higher On Price Reversal

GBPJPY: GBPJPY may have turned sharply lower on Monday but it now sees a reversal of that weakness with eyes on the 192.25 level. This present recovery is driven by its failure to follow through lower on the back of its Monday losses. On the downside, support comes in at the 189.00 level where a … “GBPJPY Recovers, Turns Higher On Price Reversal”

EURUSD – Can This Be A Real Break?

Talking Points Euro climbed higher against the US Dollar, and cleared a few major hurdles for a move towards $1.1700. The EURUSD is now correcting lower and forming an interesting structure on the daily chart. German Gross Domestic Product published by the Statistisches Bundesamt Deutschland posted a rise of +0.4% in the second quarter of … “EURUSD – Can This Be A Real Break?”

Euro Pulls Back After Yesterday’s Surge

Euro is pulling back against some of its major counterparts today. After yesterday’s surge, some Forex traders are taking profits, while others wait to see if the global instability subsides. Yesterday, global market instability boosted the euro as money flows changed direction. Euro made big gains, especially against the US dollar. Today, things are settling down a little bit and the euro is losing … “Euro Pulls Back After Yesterday’s Surge”

US Dollar Index Moves Higher, Although Gains Are Limited

US dollar index is moving higher today, recovering above the 94.00 level after yesterday’s drop to near the 92.60 level as the carnage in world markets weighed on a number of markets. Today, things are looking mostly up, and the greenback is higher, although gains are limited by speculation that the Fed won’t move to raise rates until the first quarter of 2016. Speculation that the Federal Reserve will raise interest rates … “US Dollar Index Moves Higher, Although Gains Are Limited”

NZ Dollar Gains After Monday’s Plunge

The New Zealand dollar reversed its movement after yesterday’s slump, rising a bit today. Gains were nowhere near the previous losses, though, and it may be nothing more than just a small correction. The New Zealand dollar behaved very similar to its Australian counterpart, plunging yesterday (sinking more than 5 percent against the Japanese yen) but bouncing a little today. Unlike the Aussie, the kiwi got … “NZ Dollar Gains After Monday’s Plunge”

Australian Dollar Recovers After Huge Slump

The Australian dollar rose today even though neither domestic macroeconomic data nor the general market sentiment was supportive for the currency. It looks like traders thought yesterday’s mind-boggling losses were a bit excessive. Conference Board reported today that the leading index for Australia dropped 0.2 percent in June after rising at the same rate in the preceding month. The report followed the Monday’s news from China that hurt most … “Australian Dollar Recovers After Huge Slump”

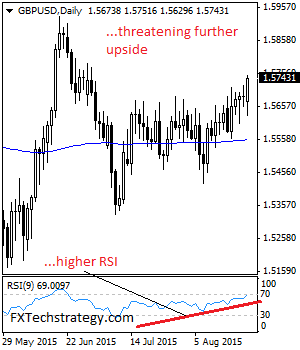

GBPUSD: Reinforces Its Bullish Offensive

GBPUSD: GBP continues to face upside pressure following its corrective recovery bullish offensive. With the pair trading above its cluster of resistance at the 1.5689/77 zone, more strength is envisaged. Further out, resistance resides at the 1.5800 level followed by the 1.5800 level. A turn above here will open the door for a run at … “GBPUSD: Reinforces Its Bullish Offensive”

EUR/USD: Squeezing Both ECB And Fed; How To Trade It?

EUR/USD shot up and is trading on high ground. Has it stabilized here? Is it going to stabilize at all? A lot depends on central banks. Here is Nordea’s take: Here is their view, courtesy of eFXnews: China and EM fears is currently triggering massive de-risking in global markets, leading to a substantial squeeze higher … “EUR/USD: Squeezing Both ECB And Fed; How To Trade It?”

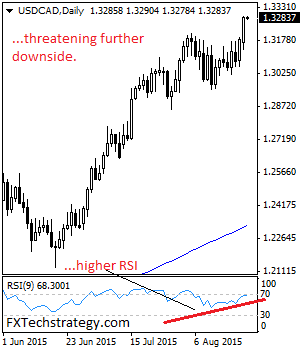

USDCAD: Resumes Medium Term Uptrend

USDCAD: Having followed through higher on the back of its Friday gains, further bullishness is envisaged. In such a case, USDCAD will aim at the 1.3350 level where a break will target the 1.3400 level. Further out, resistance comes in at the 1.3450 level where a turn lower may occur. But if further recovery is … “USDCAD: Resumes Medium Term Uptrend”